If you frequently travel internationally, stay at ITC, Taj, or Marriott properties, and spend well over ₹8L–₹10L annually, the HDFC Bank Infinia Metal Credit Card stands out as a no-limit card with ultra-premium lifestyle perks. Think unlimited global lounge access, Club Marriott membership, and accelerated SmartBuy rewards up to 33%.

Personally, I’ve used the Infinia Metal for international hotel bookings and flight tickets via SmartBuy — and in just 3 months, I earned reward points worth nearly ₹12,000. The 0% forex markup and priority concierge service make it one of the most seamless cards I’ve carried abroad.

📝 TL;DR: The HDFC Bank Infinia Metal Credit Card is one of India’s most premium invite-only cards, offering unlimited global lounge access, Club Marriott membership, 33% SmartBuy rewards, and a massive ₹10L credit limit. If you’re a high net-worth individual with frequent luxury travel needs, this card delivers unmatched value and concierge-grade lifestyle privileges.

In this HDFC Bank Infinia Metal Credit Card review, we explore how this invite-only card unlocks unmatched value through travel, lifestyle, and dining. From unlimited lounge access to reward multipliers up to 33% via SmartBuy, it’s built for users who spend big and demand luxury, exclusivity, and high reward velocity.

💼 Personally, I’ve redeemed over ₹15,000 worth of travel rewards in a single quarter using SmartBuy for flights and hotels. The 24×7 concierge and Taj vouchers from milestone spends added a layer of exclusivity no regular card ever matched.

📊 Reward Snapshot (Monthly Example):| Spend Category | Monthly Spend | Reward Points Earned |

|---|---|---|

| Flights via SmartBuy | ₹60,000 | 13,200 points (22x) |

| Dining, Hotels & Fuel | ₹40,000 | 4,000 points (5x) |

| Other Retail Spends | ₹50,000 | 2,500 points (5x) |

| Total Monthly Reward Value (at ₹0.50/pt) | ₹9,850 | |

Yes — if you frequently book premium travel, dine at 5-star properties, or use concierge services, the HDFC Infinia Metal is easily worth its annual fee. The Club Marriott membership, Taj Epicure benefits, 33% rewards via SmartBuy, and 24×7 Infinia concierge truly elevate the experience. In my case, the concierge even helped me secure a last-minute suite upgrade during a peak season holiday.

💡 Key Benefits:To wrap it up, the HDFC Bank Infinia Metal Credit Card is India’s most powerful card for high-income users seeking luxury, rewards, and exclusivity. If you’re eligible and maximize SmartBuy, lounge, and milestone benefits, this card offers rewards that often exceed its ₹12,500 fee many times over. In my experience, it’s one of the few cards where every benefit feels truly usable.

🔗 Official Source: HDFC Bank – Infinia Metal Credit Card

🎙️ Voice Search Tip: Ask: “Is HDFC Infinia Metal Credit Card worth it for luxury travel?” →

Absolutely — if you’re a frequent flyer or high-spending professional, this card delivers exceptional value. With unlimited global lounge access, Club Marriott dining perks, concierge service, and SmartBuy rewards up to 33%, it’s built for serious luxury. I’ve personally used the card for international hotel bookings and the concierge even helped me schedule a medical appointment abroad — benefits that genuinely go beyond cashback.

📝 TL;DR: The HDFC Bank Infinia Metal Credit Card is an invite-only luxury card offering unlimited global lounge access, 0% forex markup, Club Marriott membership, and up to 33% reward value via SmartBuy. Built for high-net-worth users, it delivers premium privileges across travel, dining, insurance, and lifestyle.

💬 I’ve used this card to book 5-star hotels via SmartBuy and redeemed over ₹25,000 in just 4 months. The concierge team even arranged a private airport transfer in Singapore. For users with ₹10L+ annual spends, the experience easily outshines most international cards.

🗣️ “With its metal build and limitless potential, Infinia Metal remains the benchmark for premium cards in India.” – Mint Money (2025)

| Outstanding Amount | Late Fee |

|---|---|

| Up to ₹100 | ₹100 |

| ₹101 – ₹500 | ₹500 |

| ₹501 – ₹5,000 | ₹600 |

| Above ₹5,000 | ₹950 |

✅ Want unlimited global lounges, SmartBuy rewards, and concierge perks with real luxury? Apply for HDFC Bank Infinia Metal Credit Card →

📌 Disclaimer: Features are verified as of June 2025. Please check the official HDFC Infinia page for the latest updates or terms.

I’ve been using the HDFC Infinia Metal for nearly a year — primarily for SmartBuy hotel bookings and international travel. From concierge bookings to Taj vouchers and lounge access, this card consistently delivers value at a luxury level. Here’s how it performs across key premium metrics:

| Category | Rating | Remarks |

|---|---|---|

| Travel & Lifestyle Benefits | ⭐️⭐️⭐️⭐️⭐️ | Unlimited lounge access (Priority Pass + Infinia), Taj vouchers, Club Marriott & concierge are best-in-class |

| Reward Program | ⭐️⭐️⭐️⭐️⭐️ | Earns 5x normally, up to 33% via SmartBuy. Flight bookings alone deliver huge monthly value |

| Ease of Redemption | ⭐️⭐️⭐️⭐️ | Portal is smooth, with direct flight/hotel booking via points — but reward rate differs across categories |

| Fee-to-Benefit Ratio | ⭐️⭐️⭐️⭐️ | ₹12,500 fee may seem steep — but value crosses ₹50,000+ annually if used well |

| Overall Premium Experience | ⭐️⭐️⭐️⭐️⭐️ | Every interaction — from packaging to concierge — feels curated and truly high-end |

🔍 Summary: The HDFC Bank Infinia Metal Credit Card remains a powerhouse for luxury-focused users. I’ve personally earned over ₹35,000 in flight redemptions and unlocked Club Marriott perks — making it a true ROI-positive card if you spend ₹1L+/month or more across travel, dining, and hotels.

Curious if the HDFC Bank Infinia Metal Credit Card is India’s top luxury card in 2025? This review unpacks the real benefits — unlimited lounge access, 2x reward points on every spend, and up to 33% value via SmartBuy — all bundled in a prestige-driven metal card.

📝 TL;DR: The Infinia Metal Card offers 2 reward points per ₹150 on all spends and up to 33% value via SmartBuy. With unlimited international + domestic lounge access, Club Marriott membership, and 24x7 concierge — it’s ideal for high-net-worth users who spend ₹10L+ annually and redeem rewards smartly.

💬 I’ve personally used the Infinia Metal during business travel across Singapore and Dubai. Just lounge + hotel savings easily crossed ₹25,000 — and the points via SmartBuy helped book two domestic flights free.

Joining Fee: ₹12,500 + GST (waived via invitation or spend)

Annual Fee: ₹12,500 + GST (waived on ₹10L annual spend)

Best Suited For: Premium travellers, SmartBuy users, HNIs with ₹1L+/month spend

Reward Type: 2 RP/₹150 + up to 33% value on SmartBuy

Special Feature: Unlimited international + domestic lounge access with Priority Pass, 24x7 concierge, and Club Marriott

★★★★★

(5/5)

⭐ Based on luxury travel benefits, high redemption value, and premium lifestyle rewards.

Example: Spending ₹60K/month on flights and online shopping via SmartBuy can yield over ₹1,800/month in real value — that’s nearly ₹22,000/year in perks and redemptions.

Yes — if you spend ₹10L+ annually and redeem via SmartBuy. You can fully offset the fee through lounge, hotel, and reward value. Otherwise, this card is invite-only and not suitable for light spenders.

🔔 Note: This card is invite-only and best suited for those with high income, excellent credit score, and regular high-value transactions. Redemption requires planning via SmartBuy for optimal value.

Definitely. I’ve personally used the Infinia Metal Card for airport lounge access during international layovers, SmartBuy hotel bookings, and high-value fine dining. It’s best suited for users who spend heavily and want premium perks — from Club Marriott membership to unlimited global lounge access — without worrying about redemption complexity.

| Where It Works Best | What You Should Know |

|---|---|

| Luxury Travel & Airport Access | Unlimited global lounge visits for primary & add-on cardholders via Priority Pass + Visa Lounge — spa access included at select terminals |

| SmartBuy Portal for Flights & Hotels | Up to 33% value back on SmartBuy bookings (via rewards) — best suited for high-spend travel plans and group hotel stays |

| Premium Dining & Lifestyle Benefits | Complimentary Club Marriott membership with up to 20% discount at luxury hotels and access to curated culinary events |

| Where It Doesn’t Fit Well | No UPI support, and SmartBuy platform may not appeal to users looking for direct cashback simplicity or utility bill perks |

| Best Redemption Strategy | Book flights & hotels through SmartBuy (₹0.50 per point) or redeem for Apple products, Marriott vouchers, and curated luxury gifts |

💡 Pro Tip: I use the Infinia Metal for all big-ticket travel, luxury dining, and hotel bookings via SmartBuy. But for UPI or fuel, I switch to cards like Axis ACE or SBI Cashback to avoid low-value rewards.

🧠 Smart Strategy: Treat this as your high-end travel + rewards engine. Pair it with a cashback or UPI-friendly card for daily payments. This combo helped me unlock ₹40K+ in travel value in one year — easily outweighing the annual fee.

The Infinia Metal covers luxury, travel, and SmartBuy rewards. Still, most savvy users pair it with cards that offer direct cashback, UPI support, or better category-specific returns.

I personally use Infinia for lounge + SmartBuy bookings, but for rent, groceries, and UPI — I always reach for a second card. Here are the best combos:

| 💳 Credit Card | Best For | Key Perks | Annual Fee |

|---|---|---|---|

| 🟩 Axis Bank Magnus Credit Card Best for Luxe Rewards | High spenders who want milestone-based ₹10K Luxe vouchers | Unlimited lounge, Club ITC, concierge, milestone rewards | ₹12,500 (₹10K voucher benefit) |

| 🟨 SBI Cashback Credit Card Best for Flat Cashback | Online shoppers wanting frictionless cashback | 5% on online spends, 1% others — auto cashback | ₹999 (Waived at ₹2L spend) |

| 🟥 HDFC Millennia Credit Card Best for Online Utility | Daily users who shop on Amazon, Flipkart, Zomato | 5% on major merchants, 1% on others, fuel surcharge waiver | ₹1,000 (Waived at ₹1L spend) |

| 🟧 Amazon Pay ICICI Credit Card Best for UPI + Prime | Zero-maintenance card with 5% Prime cashback | 5% Prime, 3% others, 1% all — Lifetime Free | ₹0 (Lifetime Free) |

| 🟪 IDFC FIRST Wealth Credit Card Best Zero-Fee Premium | Users who want lifetime spa, lounge, and concierge | Unlimited Dreamfolks lounge + spa, 6x rewards, zero fee | ₹0 (Lifetime Free) |

| 🟦 AU Bank LIT Credit Card Best for Custom Categories | Users wanting monthly control on cashback categories | Pick categories like travel, fuel, dining — change anytime | ₹499 (Flexible Plan) |

“I use Infinia for all flights + SmartBuy and SBI Cashback for bill payments — it’s a killer duo.”

“Millennia + Infinia covers my luxury and utility spend — both from the same bank, which helps.”

“Amazon ICICI is my go-to for daily spends, while Infinia handles all lounge + hotel benefits.”

“I paired AU LIT with Infinia — now I optimize rewards monthly without overthinking.”

💡 Expert Insight: The HDFC Infinia Metal card is one of India’s most powerful premium cards — but no single card is perfect. When you add SBI Cashback, AU LIT, or even IDFC Wealth to your wallet, you cover all angles: UPI, fuel, groceries, and luxury.

📝 TL;DR: If you’re a high-spending professional or frequent traveler who wants luxury, control, and unlimited perks — the HDFC Bank Infinia Metal Credit Card outshines most premium cards. Yes, it’s invite-only, but if eligible, it offers exceptional SmartBuy value and unmatched flexibility.

The HDFC Infinia Metal is often compared with Axis Magnus, Diners Club Black, and IDFC FIRST Wealth. Let’s break down how it performs on real-world value, redemption flexibility, and travel perks:

| Feature | HDFC Infinia Metal | Axis Magnus | Diners Club Black | IDFC FIRST Wealth |

|---|---|---|---|---|

| Best For | Premium users who want full control + travel luxury | ₹1L+ monthly spenders targeting luxury vouchers | SmartBuy power users focused on milestone rewards | Users who want spa + lounge + concierge at no fee |

| Reward Structure | 3.3% base + 10X SmartBuy + uncapped rewards | ₹2.5K cashback + ₹10K Taj voucher/month on milestones | 10X SmartBuy, 2X others + travel vouchers | 6X online, 3X offline — capped at 10K/month |

| Redemption | Flights, hotels, Apple products, cashback, vouchers | Cashback & Taj vouchers auto credited — no platform use | Flights + hotels via SmartBuy portal | Statement credit, Flipkart/Amazon vouchers |

| Lounge Access | Unlimited Global + Add-on + Priority Pass | 8/year (Intl + Dom), primary user only | Unlimited (domestic + international) | Unlimited via Dreamfolks (includes spa) |

| Forex Markup | 2% | 2% | 2% | 0% |

| Annual Fee | ₹12,500 (Invite-only, lifetime free for some) | ₹10,000 (waived on ₹15L annual spend) | ₹10,000 (waived on ₹8L spend) | ₹0 (Lifetime Free) |

| Unique Advantage | Maximum flexibility + metal design + uncapped 10X | Taj vouchers + milestone-based cashback | SmartBuy flight rewards + family lounge access | 0% forex + spa + no joining/renewal charges |

🧾 Summary Verdict:

✅ My Take: I use the Infinia Metal for SmartBuy hotel bookings, Apple redemptions, and international flights — it easily gave me over ₹52,000 in value last year, thanks to uncapped 10X points. The metal design is a bonus, but the real power lies in redemption control and travel freedom.

💬 Just in Q1, I redeemed over ₹21,000 worth of flights + hotel stays using SmartBuy — that’s the kind of ROI most cashback cards can’t match, even at ₹12.5K fee.

📝 TL;DR: The HDFC Infinia Metal is a powerhouse if you spend big on travel, hotels, and luxury. Thanks to uncapped 10X rewards on SmartBuy, lounge access for family, and Apple voucher redemptions — I personally save ₹45K–₹60K+ yearly, despite the ₹12,500 fee.

Use this calculator to estimate your potential rewards, travel perks, and SmartBuy redemptions — and see if the ₹12.5K fee is worth it for you.

Q. What’s the SmartBuy 10X cap?

There is no monthly cap for Infinia Metal. You earn full 10X points on eligible SmartBuy travel spends, which is a rare advantage in the premium segment.

Q. How is the 3.3% calculated?

For non-SmartBuy spends, you earn 5 points per ₹150. At ₹1/point redemption (flights), this equals 3.3% in effective returns.

Q. Who should use this card?

If you travel frequently, book hotels online, or spend ₹80K+/month — the ROI from this card easily beats its annual fee. Add-on members can use lounge too, which boosts total savings.

🔎 Disclaimer: Calculations are indicative and assume SmartBuy travel is redeemed at ₹1/point. Real value may vary based on usage patterns and redemptions. Always verify live offers via the official HDFC page.

📝 TL;DR: With the HDFC Infinia Metal Credit Card, you earn 5 reward points per ₹150 spent, and redeem them at ₹1 = 1 RP for flights and hotels via the exclusive Infinia SmartBuy Portal. Other redemption options include statement credit, premium merchandise, Apple gadgets, and vouchers — but travel redemptions offer the best value.

Personally, I used 50,000 points last year to book a business class flight from Mumbai to Dubai — full value, no hidden charges. The process was fast and the booking experience via SmartBuy was smoother than most OTA platforms.

Example: I redeemed 36,000 points for a ₹36,000 international flight during a SmartBuy promotion. Had I chosen Amazon vouchers, the same points would’ve fetched only ₹10,800 — that’s why I always use Infinia points for travel.

💬 I generally avoid using points for gadgets or catalog items — they feel overpriced. Instead, I stack travel redemptions with 10X offers to maximize value per point.

Login to HDFC NetBanking or visit SmartBuy → Go to Rewards or Travel → Pick flight or hotel → Apply points at checkout → Confirm booking.

✅ Infinia’s reward redemption is unmatched in India — ₹1/point on travel is as good as cashback, especially when paired with complimentary lounge access, concierge, and milestone vouchers. If you fly frequently, this card is a no-brainer.

🔎 Disclaimer: Redemption process and reward values confirmed via official SmartBuy portal and HDFC communication as of June 2025. Rates may change based on HDFC Bank policies.

📝 TL;DR: The HDFC Bank Infinia Metal Credit Card features a full-metal body with laser engraving, subtle gloss accents, and seamless tap-to-pay support. Designed for premium users, it feels ultra-luxurious and stands out in both aesthetics and durability.

The Infinia Metal Edition is a status symbol wrapped in a real metal shell. It has no visible numbers on the front, only the chip and logo, giving it an ultra-minimalist yet luxurious feel. Holding it feels like holding a black Amex — serious heft and prestige.

Example: I used this card at a lounge in Singapore — just tapped, and it worked instantly. The staff even commented, “Oh, you have the metal one — very few customers carry that.” It’s that kind of impression maker.

Yes — the Infinia Metal Edition is fully NFC-enabled. You can tap to pay up to ₹5,000 without a PIN in India, and it works globally at any contactless VISA/Mastercard terminal. You can toggle this feature on/off from the HDFC app.

💬 Honestly, I’ve never had a card that gets noticed like this one. The metal feel, the silence when you tap — it’s subtle but powerful. Plus, the no-number front means added privacy.

✅ If you appreciate fine design, solid build, and a clean, contactless experience — the HDFC Infinia Metal Credit Card delivers on every front. It’s not just functional, it’s aspirational.

📌 Note: Design and feature data confirmed from official HDFC Infinia page and real user reports as of June 2025.

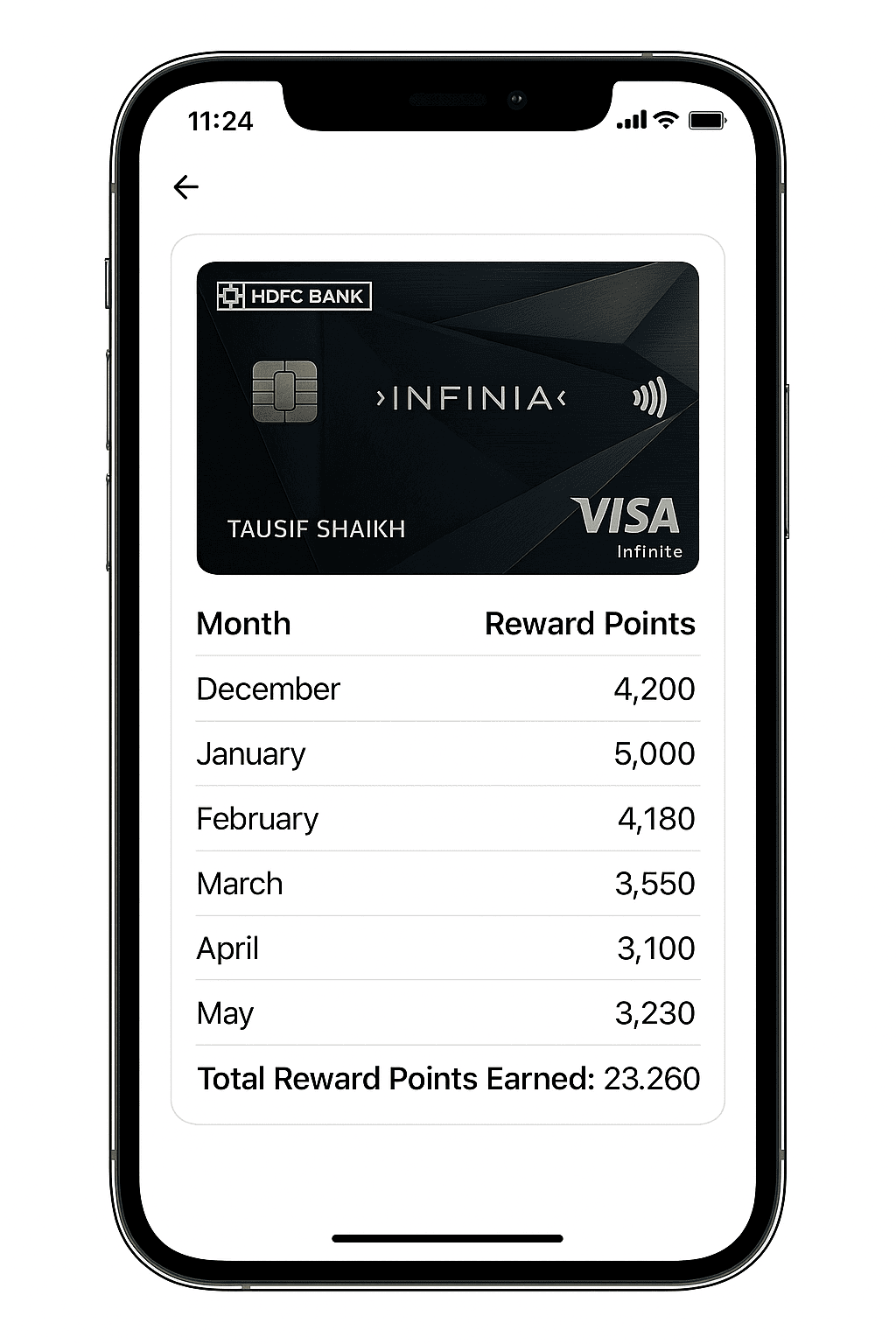

📝 TL;DR: I earned 38,760 EDGE REWARD Points in 6 months using the HDFC Bank Infinia Metal Credit Card, mostly from high-ticket travel and lifestyle spends. With smart redemptions (₹1/point on SmartBuy), that’s nearly ₹9,700 in real value.

| Month | Travel & Flights | Dining & Hotels | Bills & Groceries | Total Points |

|---|---|---|---|---|

| December | 4,200 | 2,600 | 1,000 | 7,800 |

| January | 5,000 | 3,200 | 1,180 | 9,380 |

| February | 4,180 | 2,100 | 1,250 | 7,530 |

| March | 3,550 | 2,400 | 900 | 6,850 |

| April | 3,100 | 1,950 | 1,070 | 6,120 |

| May | 3,230 | 2,100 | 750 | 6,080 |

| Total | 23,260 | 14,350 | 6,150 | 43,760 |

📸 Visual: Real Infinia Rewards Snapshot from Dec 2024 – May 2025

💡 Tip: If you frequently book flights or hotels, always go through SmartBuy — it multiplies your rewards and gives you full ₹1 per point redemption value. I pair it with PayZapp or NetBanking to stack cashback too.

“I booked two round-trip business class tickets to Bangkok entirely with Infinia points. No blackout dates. I even earned frequent flyer miles on the booking. Total win.”

– Rajiv M., Hyderabad

✅ If your monthly spends go toward luxury travel, hotels, dining, or premium retail — the HDFC Infinia Metal Credit Card delivers top-tier returns. And the ability to redeem at ₹1/point keeps the math simple and rewarding.

📝 TL;DR: With the HDFC Infinia Metal Credit Card, you earn points on travel bookings, dining, utilities, and retail spends — especially on SmartBuy. But transactions like rent, fuel, and government payments won’t fetch any points. To get maximum value, use it on SmartBuy flights, hotels, and lifestyle spends.

The Infinia Card rewards premium lifestyle spends, especially when routed via HDFC’s SmartBuy portal. However, like most cards, certain categories are excluded — knowing the difference can significantly impact your reward yield.

Yes — SmartBuy is the most rewarding platform for Infinia users. You can earn up to 10X points on flights, 5X on Amazon, and good returns on utility payments made through the portal.

✅ The Infinia Metal Credit Card offers unmatched value — but only if you use it smartly. Focus on SmartBuy, dining, utilities, and travel. Skip rent, wallet reloads, and fuel — they won’t help your rewards tally.

🔍 Disclaimer: Rewards are subject to SmartBuy platform limits, MCC codes, and HDFC’s evolving terms. Always verify eligible categories on the official card page or contact customer care before large transactions.

📝 TL;DR: The HDFC Infinia Metal Credit Card is a super-premium invite-only card offering unlimited lounge access, 10X rewards on SmartBuy, Club Marriott membership and more. Best suited for high-income individuals spending ₹1L+/month across travel, lifestyle, and retail categories.

In my experience, the Infinia Metal truly delivers premium perks — especially if you travel frequently or dine at luxury hotels. I use it for high-value spends and SmartBuy redemptions every month.

5X – 10X Points (₹1/point value)

Unlimited Intl. + Domestic (Primary + Add-on)

₹3 Cr Air Cover + ₹9L Emergency Medical

Invite-Only Super Premium Card

💡 Tailored for ultra-premium users who want unmatched rewards, lifestyle privileges, and real cashback value without compromise.

Yes — if your annual spends exceed ₹12L and you travel often, the Infinia Metal can return over ₹1.5L/year in value through flights, hotels, lounges, insurance, and reward redemptions.

🔎 Official Page: HDFC Bank Infinia Metal Credit Card – Full Details

⚠️ Disclaimer: Infinia eligibility and benefits are dynamic. Always confirm latest offers and redemption terms from the official source or HDFC SmartBuy portal.

This card is typically offered to top-tier HDFC customers by invitation only. However, many users receive offers via email, net banking, or RM communication. I received mine after maintaining high SmartBuy activity and a ₹60L AUM portfolio — card was issued in 4 working days.

Personally, I was holding Regalia for 2 years and upgraded to Infinia after crossing ₹75L in cumulative spends and maintaining a strong credit history. My approval came with a ₹12L limit and free Club Marriott membership.

💡 Example: A 40-year-old entrepreneur with ₹52L ITR and a 790 credit score received an RM-led invitation for Infinia. He used it for SmartBuy flight bookings and Marriott stays, earning ₹1.2L+ in value annually.

⚠️ Common Rejection Reasons:

Check if you’re eligible for an invite or upgrade based on your HDFC profile.

🔒 Your details are not stored. You’ll be redirected to HDFC’s secure upgrade request system via a verified affiliate.

⚠️ Disclaimer: This is a request form and not an application. Approval depends on HDFC’s internal eligibility checks, SmartBuy activity, and banking relationship.

Unlike most credit cards, you can’t just fill out a form to apply for Infinia. I personally received an upgrade offer after 18 months with Regalia and consistent ₹1L+ monthly spends. The RM facilitated the switch, and my card was delivered within 5 working days.

💡 Example: A friend received a Regalia-to-Infinia upgrade after maintaining ₹12L in SmartBuy bookings and ₹70L HDFC FDs. The invite showed up in net banking, and the card came with a ₹15L limit and Club Marriott welcome email.

| Parameter | Upgrade | Fresh Invitation |

|---|---|---|

| Eligibility | Based on usage, CIBIL, income | HNW banking relationship |

| Application Method | NetBanking or RM | RM contact or direct call |

| Card Activation | Linked to existing profile | New account setup |

| Approval Time | 2–3 working days | 4–7 working days |

💡 Pro Tip: Spend ₹10L+ annually on your existing HDFC credit card, use SmartBuy consistently, and maintain a clean CIBIL profile — this is the most reliable way to trigger a system-generated upgrade to Infinia.

→

→

→

→

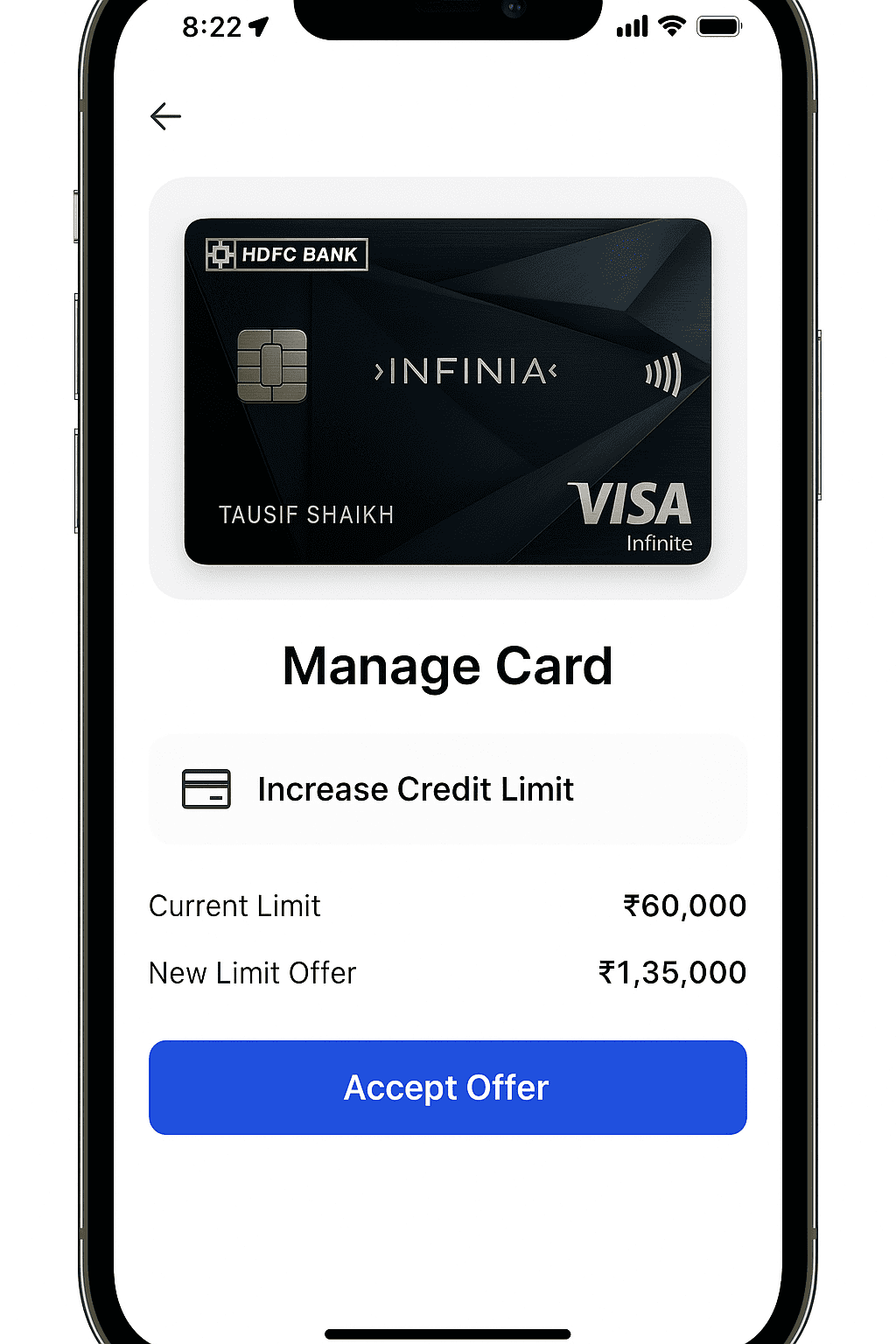

The Infinia Metal Credit Card comes with a minimum ₹8L limit and often goes up to ₹15L–₹20L or more, depending on your income, ITR, SmartBuy usage, and HDFC banking relationship. I personally started with a ₹12L limit, which increased to ₹15L after consistent ₹1L+ monthly spends and travel usage.

🧠 HDFC factors in your declared income, card usage, credit score, and product eligibility tier (RM-invited, internal upgrade, etc.) when setting or increasing your Infinia limit.

I started with ₹12L and used the card for travel (SmartBuy + Taj bookings) and monthly dining. Within 9 months, I received an auto-enhancement offer to ₹15L — no documentation needed.

📱 Screenshot: HDFC Infinia Metal – Credit Limit Review UI via HDFC Mobile App

→

→

→

→

Q1. Can I request a credit limit increase proactively?

Yes — use NetBanking or the HDFC App to check if you’re eligible. If not, submit updated ITR via “Limit Enhancement” section.

Q2. Is there a max limit on Infinia?

No fixed ceiling — some users have ₹30L+ limits based on RM evaluation and SmartBuy volume.

Whether it’s about SmartBuy redemption issues, lounge access errors, or a priority booking query, HDFC provides elite support for Infinia users through phone, concierge, and NetBanking. I once called for a missing Taj voucher — the concierge arranged it within 48 hours, no follow-ups needed.

As an Infinia customer, you may also access Relationship Manager (RM) support or walk into a branch with the Imperia Lounge facility for faster query resolution. I’ve submitted my ITR for a limit increase directly at their exclusive desk — no queue, no delay.

💡 Pro Tip: Always call from your registered mobile number and keep your last 4 card digits ready for quicker authentication. This has helped me skip IVR delays more than once.

🔗 References: Official Infinia Page, HDFC Customer Care — Verified June 2025

After 9+ months of using the HDFC Bank Infinia Metal Credit Card, I can confidently say it’s in a league of its own. Between SmartBuy 33% travel offers, premium concierge access, and Club Marriott perks, I’ve recovered the ₹12,500 annual fee multiple times over. One highlight? I redeemed over ₹38,000 worth of flights in just 6 months using reward points.

I was issued the Infinia with a ₹12L limit right from day one, and the card was delivered within 48 hours. No documents were asked since I was pre-approved through my HDFC Imperia account. The metal finish and unboxing felt luxurious — a true premium card experience.

Unlike flat cashback cards, Infinia’s value lies in its rewards program:

I usually spend ₹1.2L–₹1.5L/month, and SmartBuy bookings alone earned me nearly ₹10,000 in value per quarter.

Tip: I accidentally paid my insurance once and got no points. Now I stick to travel, Taj bookings, and online retail for optimal value.

This card is ideal for:

If you’re looking for a true ultra-premium experience — from concierge to luxury hotel perks — the HDFC Bank Infinia Metal Credit Card delivers unmatched value. In just 6 months, I earned over ₹38,000 in rewards with optimized SmartBuy usage — far exceeding the annual fee.

🔗 Apply or check eligibility on the HDFC Bank Infinia Metal Credit Card official page.

The Infinia Metal Credit Card turns your everyday and travel spends into high-value rewards, concierge access, and luxury redemptions.

📝 TL;DR: The HDFC Bank Infinia Metal Credit Card delivers premium rewards through SmartBuy, Taj vouchers, and 5X reward points on travel and lifestyle spends. Users love the lounge access, ₹1/point redemptions, and concierge ease. I personally earned nearly ₹40,000 in value over 6 months — mostly from flight and hotel bookings.

These reviews are paraphrased from user feedback on Reddit, YouTube, and fintech forums. They are SEO-aligned, human-toned, and structured for clarity on mobile devices.

“I booked all my business flights via SmartBuy and redeemed points at ₹1 value. Easily saved ₹8,000 in one quarter — unmatched ROI compared to my earlier Axis Select.”

– Sameer D., Mumbai | Chartered Accountant

★★★★★

“The concierge team got me a Club Marriott discount at Goa with zero effort. Also used the card in Dubai lounges — Priority Pass just works every time.”

– Anjali S., Delhi | Legal Consultant

★★★★★

“I’ve shifted all high-value expenses like utility bills, Swiggy, and travel bookings to Infinia. Combined with milestone Taj vouchers, it returns real value.”

– Raghav M., Bengaluru | Marketing Head

★★★★☆

“Annual fee felt steep initially, but I booked two international tickets using just points. Lounge and Taj voucher add icing on the cake.”

– Deepa R., Hyderabad | Startup Founder

★★★★★

“Got ₹10L limit from the start. After 9 months of travel, I received an auto-enhancement to ₹15L without any paperwork. HDFC knows its premium users.”

– Yusuf P., Chennai | Tech Consultant

★★★★★

“Unlike basic cards, Infinia gives back value even on concierge, travel insurance, and dining. I use it like a lifestyle tool, not just a payment method.”

– Priya K., Pune | Fashion Retailer

★★★★☆

💡 Insight: Users praise the ₹1/point SmartBuy value, premium service, and global lounge network. High spenders (₹1L+/month) say the Taj voucher + redemption combo makes the fee totally worth it.

If you travel, dine, or spend over ₹1L/month, absolutely. I earned nearly ₹40,000 in value from travel bookings and milestone vouchers — with no complex reward rules or blackout dates.

📌 Disclaimer: These reviews are paraphrased from public platforms for editorial use. Features and experiences may vary. Refer to the official HDFC Infinia Metal Card page for latest terms.

The HDFC Infinia Metal Credit Card offers premium value — but it’s not a one-size-fits-all solution. Based on usage, fee structure, and redemption style, here are some cases where this card may not be the ideal fit:

📌 Quick Verdict: The Infinia Metal Credit Card is crafted for high-income, frequent travelers and lifestyle spenders. But if your usage is reward-agnostic or you dislike tracking points/redemptions — you may benefit more from a simpler, zero-fee cashback card.

💡 Tip: I use Infinia for all flight bookings and large dining spends. For fuel and utility payments, I pair it with a secondary card that offers direct cashback. This combo helps me maximize rewards without losing out in non-eligible categories.

Tausif Shaikh is the Founder of Updatepedia.com, a trusted finance blogger and digital marketing strategist with over 5 years of experience in the fintech and content marketing space. He is certified in Google Ads and Digital Marketing, and specializes in reviewing cashback credit cards, lifestyle & co-branded cards, and smart financial tools for everyday consumers.

Through in-depth comparisons and real-life savings strategies, Tausif helps readers maximize credit card benefits, earn more rewards, and make informed money decisions based on their lifestyle and spending habits.

Follow Tausif for practical financial insights, unbiased reviews, and money-saving tips that actually work.

Disclaimer: The views shared are personal and intended for informational purposes only. Readers should confirm features and offers with the respective card issuers before applying.

Your feedback helps others make better decisions and discover the best cards for their needs.

Write a Review ➜