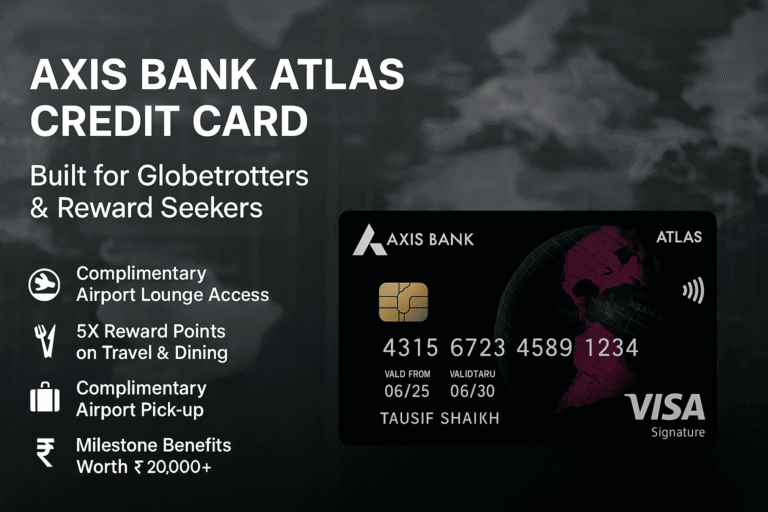

Axis Bank Atlas Credit Card Review

Axis Bank Atlas Credit Card Review 🧾 Axis Bank Atlas Credit Card Review: Ideal for High-Spend Jetsetters in 2025? Welcome to this hands-on Axis Bank Atlas Credit Card Review, built specifically for those who thrive on premium travel experiences. This…