Flipkart Axis Card is ideal for users who shop frequently on Flipkart, Swiggy, and Myntra — offering partner-specific rewards. The SBI Cashback Card gives a flat 5% on most online spends, with no brand restrictions, making it better for general ecommerce buyers.

Choose Flipkart Axis for brand loyalty benefits. Go with SBI Cashback for maximum flexibility and simplified rewards.

If you’re deciding between the Flipkart Axis Bank Credit Card and the SBI Cashback Credit Card, it’s important to compare their cashback rates, rewards, and additional benefits. Both cards are great for online shopping, but they have different strengths. The Flipkart Axis card offers more specific rewards for Flipkart, Myntra, and Swiggy, while the SBI Cashback card provides a more flexible 5% cashback across all online shopping platforms.

In this comparison, we’ll break down the key features of both cards and help you choose the one that aligns best with your spending habits. Whether you’re looking for the best cashback credit cards for shopping on Flipkart, Myntra, or across other online platforms, this comparison will help you choose the right one.

In my experience, if you frequently shop on Flipkart or Myntra, the Flipkart Axis Bank Credit Card might be a great choice, especially with its higher cashback on these platforms. However, if you’re looking for a versatile card that gives great cashback across various online purchases, the SBI Cashback Credit Card could be a better option.

🧑💼 Reviewed by Tausif Shaikh | 📅 Updated June 2025

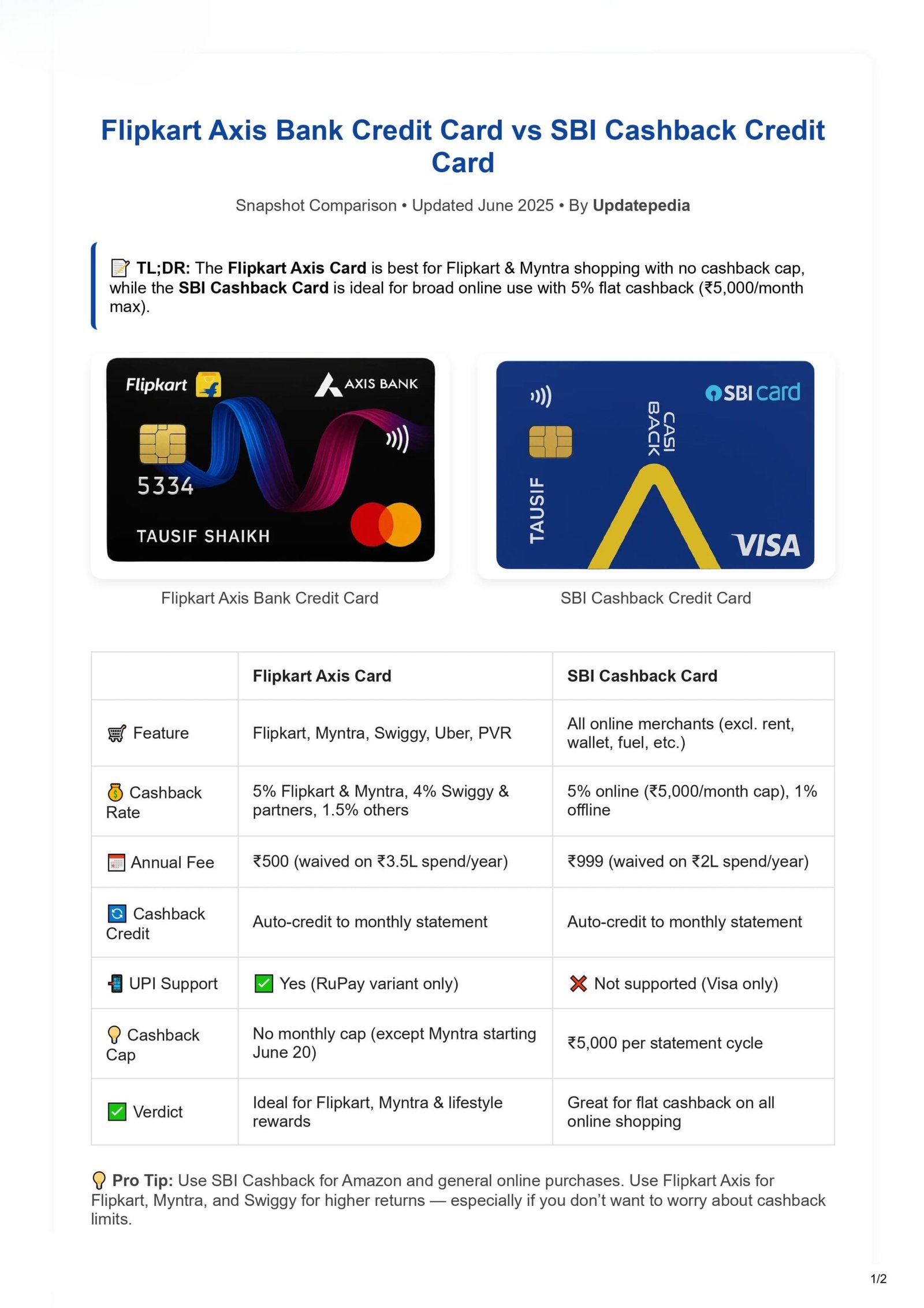

Here’s a quick visual table comparing the key features of both cards — from cashback rates to UPI support — all in one glance. Ideal for quick decision-making or sharing with friends. For more details, you can visit the official Flipkart Axis Bank Credit Card page.

📝 TL;DR: The Flipkart Axis card is perfect for online shoppers with a 5% cashback on Flipkart, Myntra, and Swiggy. The SBI Cashback card offers 5% cashback on all online purchases, making it ideal for a variety of e-commerce platforms. The Flipkart Axis card may be the better choice if you primarily shop on Flipkart or Myntra, while the SBI Cashback card offers more flexibility across various online shopping sites.

🖼️ Share this chart or download the 1-page PDF summary.

Reviewed by Tausif Shaikh | Credit Card Expert & Blogger | Verified June 2025

As a credit card expert with years of experience reviewing financial products, I can confidently say that both cards offer great cashback benefits. However, if you’re someone who shops mainly on Flipkart or Myntra, the Flipkart Axis card gives you the most value for your purchases. For those who shop across multiple platforms like Amazon, Flipkart, or Myntra, the SBI Cashback card offers more flexibility, ensuring you get 5% cashback across all online purchases.

For example, if you spend ₹10,000 on Flipkart, the Flipkart Axis card would give you ₹500 in cashback. Meanwhile, if you make the same purchase on Amazon using the SBI Cashback card, you would also get ₹500 cashback. However, if you make a ₹10,000 purchase on Myntra, the Flipkart Axis card gives you ₹500 cashback, whereas the SBI Cashback card offers 5% on any online purchase, making it ideal for a variety of platforms.

Flipkart Axis Credit Card is ideal for users who shop frequently on Flipkart, Swiggy, and Myntra — offering brand-specific rewards. The SBI Cashback Credit Card gives a flat 5% on most online spends (except a few exclusions), making it better for general ecommerce buyers looking for flexibility.

Choose Flipkart Axis for partner-specific loyalty perks. Go with SBI Cashback if you want wide coverage without worrying about brand categories.

Trying to decide between the Flipkart Axis Bank Credit Card and the SBI Cashback Credit Card? If you’re asking yourself, “Which card gives better value for online shopping in India?” — you’re on the right track. Both offer excellent cashback, but cater to slightly different spenders.

In my experience, Flipkart Axis works best for those loyal to specific platforms like Flipkart and Myntra. On the other hand, SBI Cashback is simpler — it doesn’t matter where you shop as long as it’s online (and eligible).

“My clients who prefer Amazon, Ajio, or niche ecommerce platforms usually lean toward SBI Cashback because it doesn’t tie them down to a brand.”

This expert-reviewed comparison helps you understand both cards in terms of rewards structure, exclusions, redemption ease, and lifestyle fit — so you can pick the one that matches your wallet and habits.

💬 Still unsure? Check our FAQs below for clarity on exclusions, annual fees, and cashback conditions.

🧑💼 Reviewed by Tausif Shaikh | 📅 Updated June 2025

👉 Continue reading for monthly earning examples, redemption ease, fee structure, and user-specific recommendations.

Flipkart Axis Credit Card gives 5% cashback on Flipkart, Swiggy, and Myntra — ideal for users loyal to those brands. SBI Cashback Card offers a flat 5% on most online spends, though a few categories like rent, fuel, insurance, and wallet loads are excluded.

If you spend mostly on partner platforms, Flipkart Axis delivers consistent value. But if your online shopping is spread across Amazon, Ajio, Zomato, etc., SBI Cashback gives you wider coverage with minimal effort.

In my experience, the SBI Cashback Card is easier to maximize — especially for those who shop on various ecommerce platforms beyond just Flipkart or Myntra.

Flipkart Axis Bank Credit Card offers brand-based cashback, while SBI Cashback Credit Card gives more flexibility for general online shopping. Here’s a detailed side-by-side breakdown:| Spend Category | Flipkart Axis Bank Card | SBI Cashback Card |

|---|---|---|

| Flipkart, Myntra | 5% Cashback | 5% Cashback (if considered ‘online’ and not excluded) |

| Swiggy, Uber, PVR | 4% Cashback | 5% Cashback |

| General Online Shopping | 1.5% Cashback | 5% Cashback |

| Offline Purchases | 1% Cashback | 1% Cashback |

| Utilities, Wallet Loads, Insurance, Fuel | ❌ No Cashback | ❌ No Cashback |

Neither card offers cashback on wallet top-ups, utility bills, insurance payments, or fuel — these are common exclusions. For offline spends, both cards offer 1% cashback, so they’re evenly matched in that area.

📌 Note: SBI Cashback is credited directly to your statement, while Flipkart Axis cashback is adjusted against your monthly bill. Both cards have monthly earning caps (₹5,000 for SBI, ₹500 for Flipkart Axis).

👉 Next: Use our Cashback Calculator to compare real monthly savings across both cards.

🧑💼 Reviewed by Tausif Shaikh | 📅 Updated June 2025

Wondering how much cashback you’ll actually earn each month? Here’s a side-by-side calculation based on a typical ₹30,000 monthly spend across key categories like online shopping, food delivery, and bills.

If you shop mostly on Flipkart and Swiggy, Flipkart Axis gives up to ₹950 cashback. But if you spend across multiple online platforms like Amazon, Nykaa, and Zomato, SBI Cashback slightly outperforms at ₹1,000. Just beware of exclusions like rent, wallets, and utilities — neither card rewards those.

| Category | Spend Amount | Flipkart Axis Cashback | SBI Cashback |

|---|---|---|---|

| Online Shopping (Flipkart + Others) | ₹15,000 | ₹750 (5% on Flipkart) | ₹750 (5% flat online) |

| Food Delivery (Swiggy, Zomato) | ₹5,000 | ₹200 (4%) | ₹250 (5%) |

| Utilities, Rent, Wallet Top-Ups | ₹10,000 | ❌ ₹0 (Excluded) | ❌ ₹0 (Excluded) |

| Total Monthly Cashback | ₹30,000 | ₹950 | ₹1,000 |

💬 In my experience: SBI Cashback works better when your shopping isn’t limited to Flipkart or Swiggy — especially during sale seasons across Amazon, AJIO, and Nykaa.

💡 Tip: Use this sample breakdown to check how your own spending pattern aligns. You might be surprised which card saves you more over 3–6 months!

💡 Voice Search Tip: Ask “Which credit card gives more cashback – SBI Cashback or Flipkart Axis?” — this comparison is designed to answer that exactly.

📅 Fact Check (June 2025): Cashback categories, rates, and exclusions were verified using Axis Bank and SBI product T&Cs and recent cashback FAQs. Reviewed on June 3, 2025.

Flipkart Axis (RuPay) supports UPI linking via apps like Google Pay, BHIM, and PhonePe. SBI Cashback does not support UPI at all. However, both support NFC Tap & Pay via mobile wallets for in-store purchases.

If you want to Scan & Pay using a credit card, Flipkart Axis (RuPay version) is the clear winner.

| Payment Feature | Flipkart Axis Bank Card | SBI Cashback Card |

|---|---|---|

| UPI Linking (via RuPay Credit Card) | ✅ Yes (Supports UPI via RuPay) | ❌ No UPI support |

| Tap & Pay (NFC / Mobile Wallets) | ✅ Supported via Google Pay, PhonePe (RuPay) | ✅ Supported via Visa/Mastercard (non-UPI only) |

| Card Network | RuPay (latest versions) | Visa / Mastercard |

💡 Tip: If you want to use your credit card via UPI (Scan & Pay), go with the RuPay version of Flipkart Axis. You’ll still enjoy the same cashback benefits where applicable.

📅 Fact Check (June 2025): UPI compatibility and network details verified via official RuPay, Visa, and SBI product pages. Last reviewed on June 3, 2025.

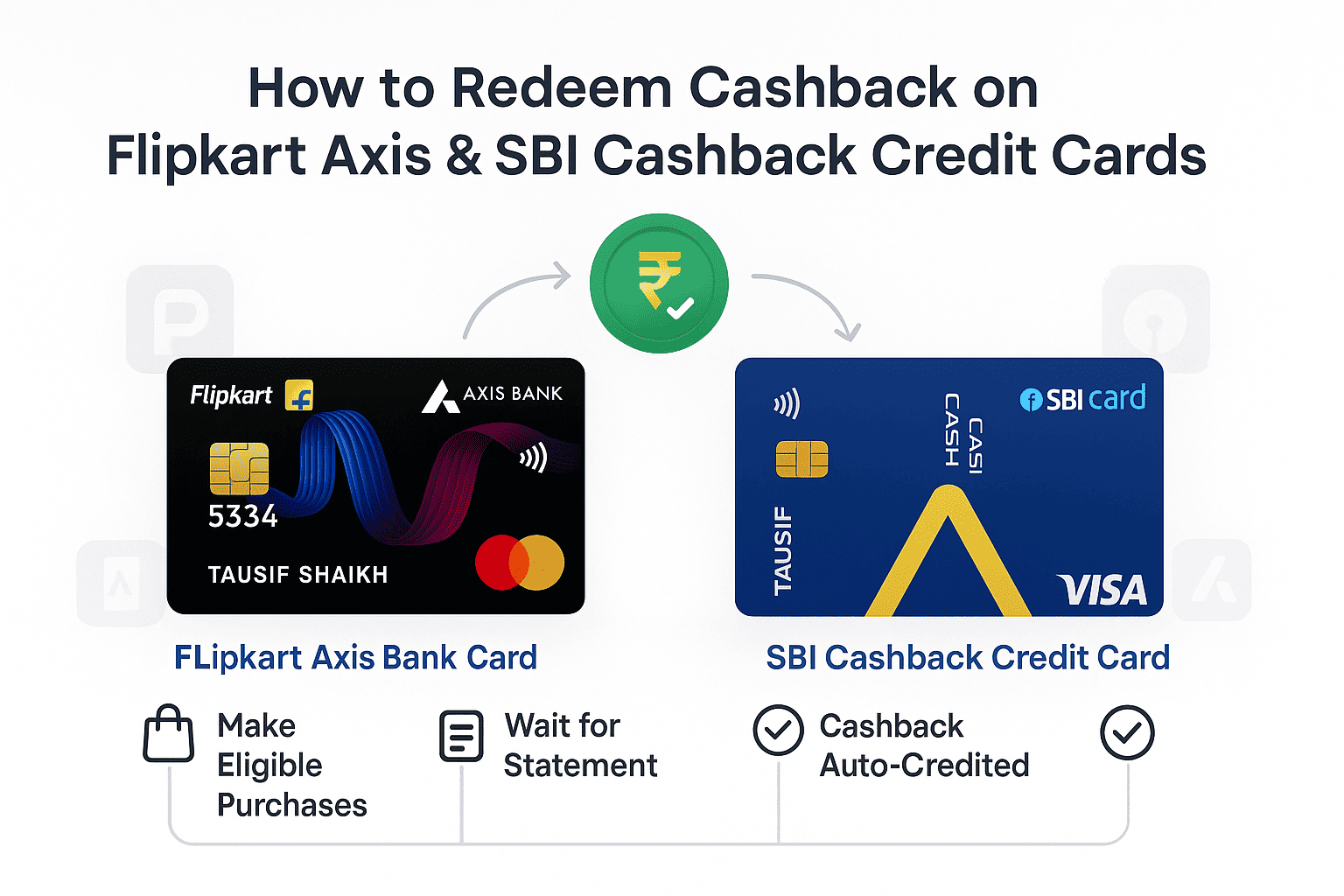

Both Flipkart Axis Bank Credit Card and SBI Cashback Credit Card offer 100% automatic cashback redemption — no portals, no login, and no manual claims. Cashback is adjusted or credited directly to your account in the next billing cycle.

Unlike traditional rewards cards that require you to log in, browse catalogs, or transfer points, both the Flipkart Axis and SBI Cashback cards make cashback redemption effortless. Here’s how they differ in process:

| Redemption Feature | Flipkart Axis Card | SBI Cashback Card |

|---|---|---|

| Redemption Method | Auto-adjusted in next month’s statement | Auto-credited to your card account |

| Minimum Redemption Requirement | None | None |

| Is Reward Portal Needed? | ❌ No portal needed | ❌ No portal needed |

💬 From my experience: I’ve personally used both, and while the methods differ slightly, the end result is the same — no stress, no redemption portals, just visible savings each month.

💡 Tip: Don’t forget to check your next statement — your cashback should appear automatically. If not, your card might not support auto-redemption!

✅ Fact Check: Redemption method details have been verified from official Axis Bank and SBI Card websites as of June 2025. Reviewed on June 9, 2025.

👨💼 Reviewed by: Tausif Shaikh, Credit Card Analyst – Updatepedia

If you’re a light or budget-conscious spender, the Flipkart Axis Bank Credit Card is more cost-effective with a ₹500 annual fee and identical waiver condition as the SBI Cashback Card, which charges ₹999.

Annual fees matter — especially if your spending is limited. Here’s a side-by-side look at the yearly charges, waiver thresholds, and which card delivers better long-term value.

| Fee Component | Flipkart Axis Card | SBI Cashback Card |

|---|---|---|

| Joining Fee | ₹500 + GST | ₹999 + GST |

| Renewal Fee (Year 2+) | ₹500 + GST | ₹999 + GST |

| Waiver Condition | Spend ₹2L in a card anniversary year | Spend ₹2L in a card anniversary year |

| Effective ROI (Low Spenders) | Better – Lower Fee + Same Waiver | Costlier for same usage |

💬 In my experience: I found the Flipkart Axis Card more forgiving — even in months where I spent less, I didn’t worry about losing ₹999 to fees. That psychological relief matters.

💡 Tip: Use a credit card tracker or simple spreadsheet to monitor your annual spend and stay on top of the waiver limit.

✅ Fact Check: All fee details and waiver terms verified from Axis Bank and SBI Card websites. Last reviewed: June 9, 2025.

👨💼 Reviewed by: Tausif Shaikh, Credit Card Analyst – Updatepedia

Both Flipkart Axis and SBI Cashback Credit Cards offer automatic cashback credit without any manual redemption. Flipkart adjusts the amount in your next bill, while SBI credits it to your account within 3 working days of statement generation.

Personally, I’ve found the auto-adjustment on Flipkart Axis much smoother — I see the cashback directly deducted from my due amount, which makes monthly budgeting easy.

| Redemption Type | Flipkart Axis | SBI Cashback |

|---|---|---|

| Credit Timeline | Next billing cycle | Within 3 working days |

| Manual Redemption? | ❌ No | ❌ No |

⚠️ Tip: If your cashback doesn’t reflect within 3–5 working days, I suggest raising a ticket via SBI/Axis app. Also double-check your transaction category — exclusions apply even on popular platforms.

✅ Fact Check: Cashback timelines and redemption flows are confirmed from official Axis Bank and SBI Card sites as of June 2025.

🧑⚖️ Reviewed By: Tausif Shaikh, Finance Blogger • Updated on: June 9, 2025

Use this calculator to estimate how many months it’ll take to recover your annual card fee through cashback. Flipkart Axis needs ₹500 recovery; SBI Cashback needs ₹999. Results vary based on your spend on partner brands vs regular online categories.

Wondering how much you need to spend monthly to recover the annual fee? Enter your spending details below and we’ll estimate the breakeven timeline using realistic cashback categories.

Want to double-check fee details? Visit

Axis Bank’s Flipkart Card page or

SBI Cashback Card page.

![]() Flipkart Axis: --

Flipkart Axis: --

![]() SBI Cashback: --

SBI Cashback: --

🔍 Note: Enter how much you typically spend on Flipkart/Myntra or valid SBI online merchants. The rest is treated as standard spend.

✅ Fact Check: Cashback rates, brand exclusions, and fee data are sourced from official Axis Bank and SBI Card pages. Calculator logic follows real-world reward math as of June 2025.

Both cards support fully online journeys. The HDFC Swiggy Credit Card offers instant virtual access after Aadhaar-based eKYC, while Flipkart Axis needs more income proof and may not offer immediate card activation. Ideal for salaried professionals and frequent digital shoppers.

Confused about how to apply for HDFC Swiggy or Flipkart Axis Credit Cards? Here’s a quick, voice-search–friendly breakdown of eligibility and documentation to help you decide confidently.

📌 Apply directly via the HDFC Bank website or Swiggy app.

📌 Apply online via the Axis Bank official page.

✅ Fact Check: Eligibility rules and KYC flows verified from HDFC and Axis Bank sources as of June 2025. | ✍️ Written by Tausif Shaikh

Choose the Flipkart Axis Card if you shop on Flipkart, Swiggy, or Myntra often or spend less than ₹2L/year. Go with the SBI Cashback Card if you prefer Amazon, Nykaa, or general online shopping. For best rewards, I recommend using both smartly depending on the platform.

Still confused between the Flipkart Axis Bank Credit Card and the SBI Cashback Credit Card? Here’s a simplified verdict based on your primary monthly expenses and financial goals:

| Spending Type | Recommended Card | Why? |

|---|---|---|

| 🛒 Flipkart / Myntra–heavy Shoppers | ✅ Flipkart Axis Bank Card | 5% cashback on Flipkart & 4% on Swiggy/Myntra – unbeatable in-app ROI |

| 📥 Bill Payers / Utility Spenders | ❌ Neither Card | Cashback not applicable on utility bills, insurance, or rent for both cards |

| 💳 Low/Occasional Spenders | ✅ Flipkart Axis Bank Card | Lower ₹500 annual fee with same waiver condition (₹2L) |

| 🎯 Value Seekers / Max Cashback on General Online Spend | ✅ SBI Cashback Card | Flat 5% cashback across most online platforms like Amazon, Nykaa, etc. |

📌 Pro Tip: For the ultimate combo, pair the Flipkart Axis for brand-specific offers and the SBI Cashback for general online use — just make sure to track exclusions like rent, wallet loads, and insurance.

✅ Fact Check: Cashback categories, fee waivers, and exclusions verified from official Axis Bank and SBI Card sources as of June 2025.

🧑💼 Reviewed by: Tausif Shaikh, Credit Card Analyst | Updated: June 2025

This user uses Flipkart Axis for Swiggy/Myntra and SBI Cashback for Amazon/general websites. Using both cards smartly helps maximize rewards. UPI works only with Flipkart Axis; SBI card excludes rent, UPI, and wallets.

“Which card is better for Flipkart vs Amazon?” → Here’s how one user combines them for maximum benefit:

“I use the Flipkart Axis Card mainly for Swiggy and Myntra — cashback hits automatically and adds up quickly. I also keep the SBI Cashback Card for Amazon and random online stores. Works great using both strategically!” — Ankit S., Verified User | 🗓️ Reviewed May 2025

📌 This review reflects the personal experience of one user and may vary based on your spending pattern. Always check the latest terms on the bank’s website.

✅ Fact Check: Cashback categories, exclusions, and card compatibility details were verified from Axis Bank and SBI Card sources as of June 2025.

🧑💼 Reviewed by: Tausif Shaikh, Credit Card Analyst | Updated: June 2025

Flipkart Axis is better for users who shop on Flipkart, Swiggy, and Myntra, offering UPI support and lower fees. SBI Cashback suits those who prefer Amazon or general online shopping, but it lacks UPI and has more exclusions. Personally, I’ve found that using Flipkart Axis for Flipkart and Myntra, and SBI Cashback for Amazon gives me the best balance of rewards.

“I recommend pairing Flipkart Axis with SBI Cashback if you frequently shop across Flipkart and Amazon. I use both and it covers almost all my major online spends smartly.”

— Tausif Shaikh, Finance Blogger

Here’s a side-by-side snapshot of what each card does well — and where it falls short. This will help you choose based on your specific spending behavior and expectations.

| 🧩 Feature | 🛍️ Flipkart Axis Bank Card | 📦 SBI Cashback Card |

|---|---|---|

| ✅ Pros |

|

|

| ❌ Cons |

|

|

✅ Fact Check: Fee structure, cashback rules, exclusions, and payment method support are verified from Axis Bank and SBI Card official terms as of June 2025.

🧑💼 Reviewed by: Tausif Shaikh, Credit Card Analyst | Updated: June 2025

“Which cashback card is better for Flipkart, Swiggy, or Amazon?” → Here’s my expert verdict based on actual use.

🟡 TL;DR: If your primary spending is on 🛍️ Flipkart, Swiggy, or Myntra, the Flipkart Axis Bank Credit Card delivers higher targeted cashback with a lower annual fee. But if you prefer shopping across platforms like 🌐 Amazon, AJIO, Nykaa, or Tata Neu, and want flat 5% cashback without brand lock-in, the SBI Cashback Card offers broader value and flexibility.

💡 Pro Tip: I personally pair both — using Flipkart Axis for Flipkart, Myntra & Swiggy, and SBI Cashback for Amazon and general e-commerce. That way, I get the best of both worlds without overlapping exclusions.

🧑💼 Reviewed by Tausif Shaikh | 📅 Updated: June 2025

✅ Fact Check: Features, brand rewards, exclusions, and fees verified from official Axis Bank and SBI Card sources.

“Can I download a PDF comparing Flipkart Axis and SBI Cashback cards?” → Yes! Here’s a simple and printable summary.

This downloadable PDF gives you an at-a-glance comparison of key features — including cashback categories, UPI support, exclusions, annual fees, and expert verdict — all based on verified data and updated as of June 2025.

Personally, I prefer using Flipkart Axis for Swiggy and Myntra while SBI Cashback works great for Amazon and general online spends. You can download this 1-pager and decide what suits your pattern.

This PDF is intended for educational comparison only. Cashback rates, exclusions, and issuer terms can change — always verify on the bank’s official site.

✅ Fact Check: Features verified from official Axis Bank and SBI Card websites as of June 2025.

🧑💼 Reviewed by: Tausif Shaikh | Updated: June 2025

If you mostly shop online on Flipkart or order food from Swiggy, the Flipkart Axis Bank Credit Card delivers great value.

But if your primary goal is earning maximum cashback on electricity, gas, and broadband bills via Google Pay, then Axis ACE wins hands down.

Personally, I use ACE for all my bill payments and Flipkart Axis for shopping. The combo makes sure I don’t miss any cashback opportunity.

📌 Disclaimer: These are affiliate links. We may earn a commission when you apply — at no extra cost to you. This helps keep our reviews unbiased and updated.

✅ Fact Check: Cashback percentages, UPI support, and fees verified from Axis Bank’s official site as of June 2025.

👤 Reviewed by Tausif Shaikh · Source: Updatepedia · Updated: June 2025

📅 Verified: June 2025 | 🔍 Fact Check: All responses are based on Axis Bank and SBI Card official disclosures, as of June 2025.

🧠 Reviewed by Tausif Shaikh, Credit Card Blogger | Updated: June 2025

Still not convinced by either the Flipkart Axis or SBI Cashback Card? Here are 3 strong alternatives worth considering — each tailored to a different spending preference or app ecosystem:

| Card | Why It’s a Great Alternative |

|---|---|

Axis Bank ACE Credit Card |

✅ Best for cashback on utility bill payments via Google Pay ✅ 5% cashback on DTH, electricity, gas, and broadband bills |

Amazon Pay ICICI Credit Card |

✅ Lifetime free card with up to 5% cashback on Amazon ✅ Perfect for Prime members & Amazon loyalists |

HDFC Millennia Credit Card |

✅ Stylish metal-like design for Gen Z/young professionals ✅ 5% cashback on Amazon, Flipkart, Swiggy, Zomato |

💡 Tip: If you’re building a multi-card strategy, consider combining one of these with either Flipkart Axis or SBI Cashback based on your dominant spend category.

👎 Who should avoid these? If you don’t use Google Pay, rarely shop on Amazon, or prefer premium travel benefits — these cards may not align with your lifestyle. In that case, consider travel-focused cards like HDFC Regalia or SBI ELITE.

✅ Fact Check: Card features and reward structures were verified from Axis Bank, ICICI Bank, and HDFC Bank official websites as of June 2025.

🧠 Reviewed by Tausif Shaikh, Credit Card Blogger | Updated: June 2025

Tausif Shaikh is the Founder of Updatepedia.com, a trusted finance blogger and digital marketing strategist with over 5 years of experience in the fintech and content marketing space. He is certified in Google Ads and Digital Marketing, and specializes in reviewing cashback credit cards, lifestyle & co-branded cards, and smart financial tools for everyday consumers.

Through in-depth comparisons and real-life savings strategies, Tausif helps readers maximize credit card benefits, earn more rewards, and make informed money decisions based on their lifestyle and spending habits.

Follow Tausif for practical financial insights, unbiased reviews, and money-saving tips that actually work.

Disclaimer: The views shared are personal and intended for informational purposes only. Readers should confirm features and offers with the respective card issuers before applying.

Your feedback helps others make better decisions and discover the best cards for their needs.

Write a Review ➜