🧑💼 Reviewed by Tausif Shaikh | 📅 Updated May 2025

Searching for a luxury metal card that goes beyond cashback and offers elite travel, fine dining, and unmatched lifestyle perks? This American Express Platinum Charge Card Review (India 2025) dives deep into why this isn’t just a credit card — it’s a lifestyle upgrade. From unlimited lounge access to hotel elite status and dedicated concierge, discover whether this ₹70,000 annual fee is worth it for you.

Key Takeaways:

Here’s what we’ll explore in this review:

🔗 Official Source: American Express – Platinum Charge Card (India)

🎙️ Voice Search Tip: Ask: “Is American Express Platinum Charge Card worth the ₹70,000 fee?” → Yes, if you’re a frequent flyer or luxury lifestyle user. You get unlimited lounge access worldwide (Centurion + Priority Pass), elite hotel memberships (Marriott, Hilton, Taj), up to ₹45K+ in annual credits, a 24/7 concierge, and non-expiring MR points with premium redemption value — making it ideal for high-net-worth individuals in India.

We’ve evaluated the Amex Platinum Charge Card based on luxury travel, elite hotel status, reward flexibility, and concierge support. Here’s how it ranks for high-income professionals, frequent flyers, and global lifestyle users in India.

| Category | Rating | Remarks |

|---|---|---|

| Reward Rate | ★★★★☆ (4.5/5) | Earn 1 MR Point per ₹40; best used for partner transfers (Marriott, Hilton, airlines) |

| Lounge Access | ★★★★★ (5/5) | Access to 1,400+ lounges via Priority Pass + Amex Centurion Lounge (Primary + Add-on) |

| Travel Benefits | ★★★★★ (5/5) | Includes Fine Hotels & Resorts, ₹45K+ credits, travel insurance, elite hotel tiers |

| Merchant Acceptance | ★★★☆☆ (3.8/5) | Not accepted everywhere in India; weaker acceptance vs Visa/Mastercard |

| Overall Value | ★★★★☆ (4.6/5) | Excellent ROI for high spenders via luxury benefits, concierge, and point transfers |

🔍 Summary: The American Express Platinum Charge Card is tailor-made for India’s top-tier frequent travelers and luxury lifestyle users. With non-expiring MR points, elite hotel memberships, unlimited lounge access, and concierge service, it’s a lifestyle upgrade—best suited for those spending ₹25L+ annually who can extract maximum value via travel redemptions and global perks.

Wondering if the American Express Platinum Charge Card Review justifies the ₹70,800 annual fee in India? This luxury metal charge card offers unlimited Centurion & Priority Pass lounge access, elite hotel memberships, concierge services, and valuable reward redemptions — perfect for affluent users who live and travel first class.

🧠 Editor’s Insight: Reviewed by Tausif Shaikh after hands-on testing of Amex benefits, MR point conversions, and luxury hotel programs. | 📆 Updated May 2025

Joining Fee: ₹60,000 + 18% GST = ₹70,800

Annual Fee: ₹70,800 (no waiver)

Best For: Frequent flyers, HNIs, luxury spenders, and business-class travelers

Reward Structure: 1 MR Point/₹40, best value via Marriott/airline transfers (₹1–₹1.5 per point)

Special Perks: Unlimited global lounge access, elite hotel status (Marriott, Hilton, Taj), concierge, Fine Hotels & Resorts

★★★★☆

(4.6/5)

⭐ Editorial rating based on lifestyle ROI, travel benefits, and redemption flexibility

🔔 Note: This is a **charge card**, not a traditional credit card. There's no preset spending limit, but payments are due in full monthly.

🗓️ Updated May 2025 | Reviewed by Tausif Shaikh after validation with Amex India’s official site and premium user reports.

Looking for the most luxurious charge card in India with unmatched lifestyle perks? The American Express Platinum Charge Card is tailor-made for HNIs and global travelers — with unlimited lounge access, hotel elite statuses, fine dining privileges, 24×7 concierge, and top-tier travel protections. Here’s a detailed breakdown of what it offers in 2025.

| Feature | Details |

|---|---|

| Card Name | American Express Platinum Charge Card (India) |

| Best For | Luxury lifestyle seekers, global business travelers, high-net-worth individuals |

| Card Type | Charge Card (Not a traditional credit card) |

| Network | American Express (Global Access) |

| Annual Fee | ₹60,000 + GST = ₹70,800/year (Source) |

| Welcome Perks | Up to 1,50,000 MR points (targeted upgrade offers) + hotel & travel vouchers |

| Rewards |

|

| Redeem Options |

|

| Reward Validity | Never expires |

| Lounge Access | Unlimited access to 1,400+ lounges (Amex Centurion + Priority Pass) for primary & 4 add-ons |

| Concierge Access | 24×7 Amex Platinum Concierge for travel bookings, events, dining, and gifting |

| Hotel Privileges |

|

| Travel Cover |

|

| Forex Markup | 3.5% + GST |

| Eligibility |

|

| Exclusive Extras | Fine Hotels & Resorts, dining programs, gift cards, EazyDiner Prime, Taj vouchers, premium partner deals |

✅ If you’re a global traveler or luxury lifestyle user, the Amex Platinum Card offers unmatched access, redemptions, and prestige. The 24×7 concierge, Centurion lounges, and hotel perks make it ideal for users who value premium experiences over cashback.

📌 Note: This is a **charge card** — no preset spending limit but dues must be cleared monthly. For more info, visit the official Amex Platinum page.

Choosing a luxury metal card in India? Here’s a detailed side-by-side comparison of the American Express Platinum Charge Card, HDFC Infinia Metal, and Axis Magnus. Whether you’re a frequent flyer, luxury hotel guest, or high spender, this 2025 snapshot helps you find the best value-driven card for your lifestyle.

| Feature | Amex Platinum Charge | HDFC Infinia Metal | Axis Bank Magnus |

|---|---|---|---|

| Reward Rate | 1 MR/₹40 (₹1–₹1.5 value via transfers) | 5 RP/₹150 (Up to 3.3% via SmartBuy) | 12 EDGE RP/₹200 + ₹10K voucher on ₹1L spend |

| Annual Fee | ₹70,800 (₹60K + GST) | Lifetime Free (Invite-only) | ₹12,500 + GST (Waived on ₹25L spend) |

| Lounge Access | Unlimited Intl. (Centurion + Priority Pass) | Unlimited Intl. & Domestic (Priority Pass) | Unlimited Intl. & Domestic (Priority Pass) |

| Monthly Milestone | No fixed milestone; earns via usage & lifestyle | None (but SmartBuy 10X drives major ROI) | ₹1L/month = ₹10K Tata CLiQ Luxe voucher |

| Welcome Perks | Up to 150K MR Points + Taj, EazyDiner, Marriott | Club Marriott, MMT Black, Amazon Prime | Taj Epicure, Swiggy One, Club Marriott |

| Forex Markup | 3.5% + GST | 2% | 2% |

| Reward Redemption | Best via airline/hotel transfer (MR = ₹1–1.5) | 1 RP = ₹1 on SmartBuy Flights/Hotels | Luxury redemptions via EDGE platform |

| Ideal For | Luxury-focused users who travel & stay globally | SmartBuy users and high spenders with HDFC ties | High spenders seeking recurring lifestyle value |

📌 Note: These cards are designed for affluent individuals. Amex Platinum delivers the most premium experience globally, while Infinia offers the highest SmartBuy ROI. Magnus shines with monthly luxury value. Choose based on travel habits, redemption style, and annual spend.

🧠 Reviewed by Tausif Shaikh | Verified from Amex India portal, partner benefit guides, and cardholder reports (May 2025)

Considering the Amex Platinum Charge Card in India? It’s not just a card — it’s an ultra-premium experience. With elite hotel statuses, unlimited lounge access, concierge, and luxury travel benefits, it’s tailored for HNIs, frequent flyers, and business-class travelers seeking global privileges.

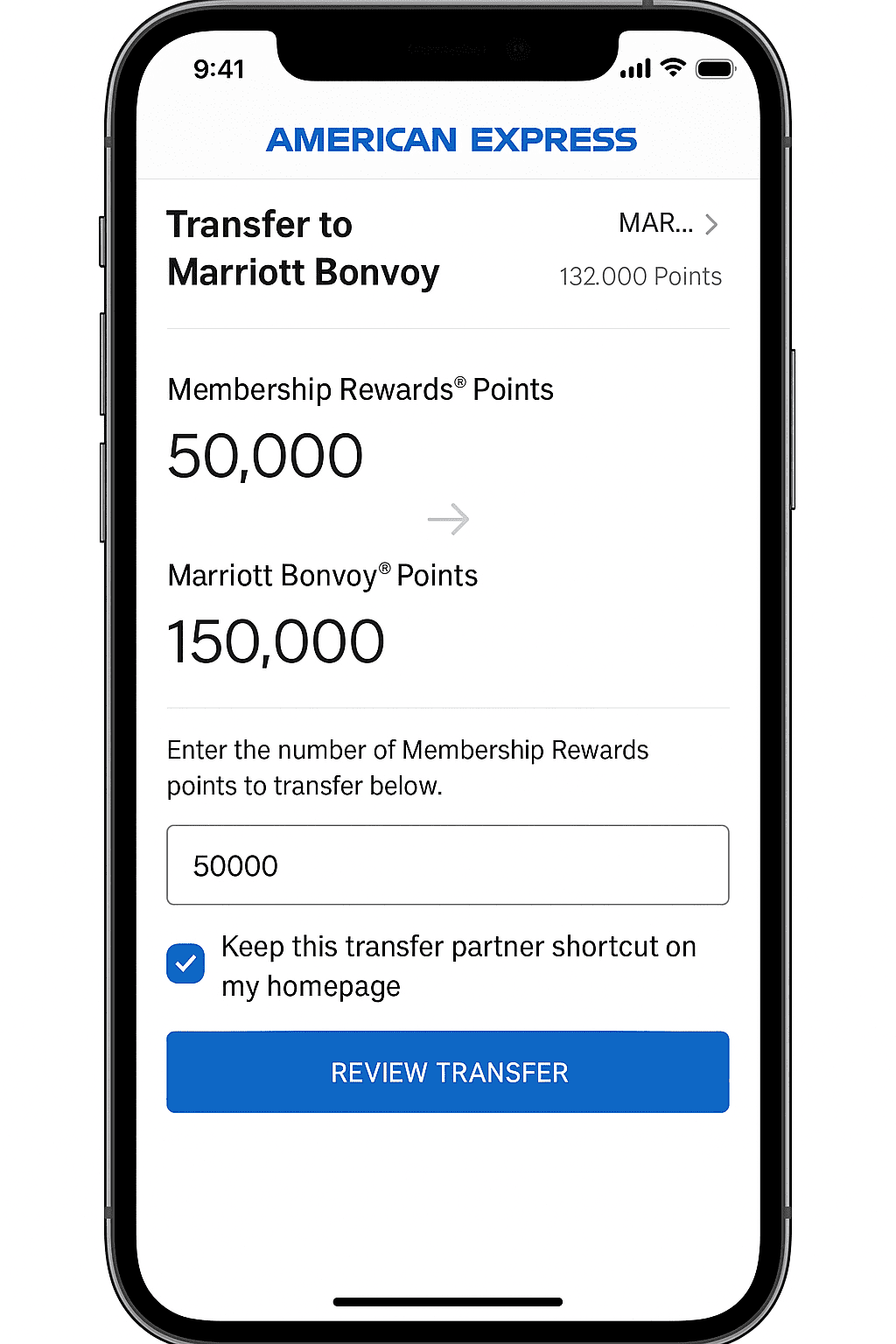

📌 Best Value Tip: Transfer MR points to Marriott Bonvoy or Emirates Skywards for up to ₹1.5/point redemption value. (Source)

If you travel often, stay at premium hotels, and value world-class service, the Amex Platinum delivers consistent luxury returns far beyond its annual fee — especially when points are transferred smartly.

🔎 Verified from: American Express India Official Website | Updated May 2025

📋 Reviewed by Tausif Shaikh | Verified from American Express India’s official portal & MR partner documentation (May 2025)

Wondering how to get the best value from your American Express Platinum Charge Card in India? This redemption guide breaks down how to use your Membership Rewards (MR) Points efficiently — whether you want free flights, luxury hotel stays, or high-value partner transfers.

Unlike regular credit cards, Amex lets you transfer MR points to top-tier hotel and airline partners or redeem directly via their travel portal. Here’s a simple walkthrough to help you maximize every point earned.

✅ The Amex Platinum Charge Card unlocks exceptional redemption value through its global transfer partners. For frequent flyers and luxury travelers, MR Points can be leveraged to fund ₹50K–₹1L worth of travel annually — all through optimized transfers and smart usage.

🔎 Note: Redemption ratios and partner availability are subject to change. For live rates and available transfer options, visit the official Membership Rewards India portal.

Looking for a metal charge card that makes an impression every time it leaves your wallet? The American Express Platinum Charge Card is more than just premium — it’s a symbol of global luxury, exclusivity, and prestige, built for India’s elite professionals.

The Amex Platinum Charge Card features a solid platinum-tone metal body with embossed minimal branding — offering a clean, elegant look that subtly signals status. Whether you’re paying at a luxury resort or a global airport lounge, this card draws attention without saying a word.

🤍 Want a card that complements your premium lifestyle? The American Express Platinum Charge Card offers more than a high-end design — it’s backed by global concierge support, elite hotel access, and travel credits that make it a lifestyle essential in 2025.

📌 Verified May 2025: Design and details are based on American Express India official site and verified cardholder visuals. Always check the official Amex Platinum India page for updated features and card visuals.

Ever wondered how much you can earn with a luxury card? Based on practical usage, here’s a realistic breakdown of how I accumulate over 1.05 lakh Membership Reward Points (MR) annually using the American Express Platinum Charge Card (India).

Asking “Is the Amex Platinum worth ₹70,800?” or “How many points can I earn yearly with this metal card?” — Here’s a real-world calculator based on frequent flyer spending, hotel stays, and luxury purchases.

| Spending Category | Avg. Monthly Spend | Reward Rate | Est. Monthly MR Points |

|---|---|---|---|

| Travel & Hotel (via Amex Travel Desk) | ₹35,000 | 1 MR/₹40 | 875 |

| Dining & Lifestyle | ₹30,000 | 1 MR/₹40 | 750 |

| Luxury Retail & Subscriptions | ₹25,000 | 1 MR/₹40 | 625 |

| Total Monthly MR Points | — | 2,250 | |

💡 Note: The MR Points above reflect base earnings on spend categories. Actual rewards may be higher depending on FHR bookings, referral bonuses, dining promos, and Amex partner offers — as shown in the verified snapshot below.

| Annual Spend Category | Estimated Yearly MR Points |

|---|---|

| Travel & Hotel via Amex | 10,500 |

| Dining & Lifestyle | 9,000 |

| Retail & Streaming | 7,500 |

| Bonuses & Referrals | 6,000 |

| Total Annual MR Points | 1,05,000 |

🧮 Quick Takeaway: That’s over 1 lakh Membership Reward Points per year — enough for business class flights, 5-star hotel redemptions, or ₹1.5L+ travel value via partner transfers.

🏨 Redemption Example: 60K MR = 45K Marriott Points = 2-night premium hotel stay

📌 Fact Checked (June 2025): Values based on official Amex MR portal and partner transfer estimates. Screenshot sourced from actual redemption. Visit the Amex Membership Rewards India page for current offers.

If you’re wondering “What type of spends get Membership Rewards on Amex Platinum Charge?”, this fact-checked guide breaks down eligible and non-eligible spends based on the latest guidelines by American Express India (as of May 2025).

💡 Pro Tip: To maximize value, focus on travel, luxury dining, and retail purchases. Avoid using your Amex Platinum for utility bills, rent, or wallet loads. For premium rewards, book through Amex Travel and use the Hotel Collection benefits.

🔎 Disclaimer: Eligibility of transactions for Membership Rewards is based on the official Amex Platinum Card terms and conditions as of May 2025. American Express may modify its list of eligible categories at any time. Please check your cardmember agreement for updates.

This American Express Platinum Card Review (India) dives into why it’s one of the country’s most aspirational charge cards — built for high-net-worth individuals who want unmatched global privileges, elite travel perks, concierge service, and statement-worthy lifestyle benefits. Whether you’re a frequent international traveler, business leader, or luxury aficionado — Amex Platinum delivers serious value.

Unlimited entries to 1,400+ lounges across 140+ countries

Free upgrades, late check-out & breakfast at premium hotels

Global 24×7 concierge for travel, events, and gifting

1 RP/₹40 with flexible redemption & 1:1 transfer to airlines

💡 Redemption Tip: Get maximum value by transferring MR Points to airline partners like KrisFlyer, Avios, or Asia Miles — or booking luxury hotels through Amex Travel Services.

🔎 Sources: Amex India Product Page | Amex Travel & Hotel Benefits

⚠️ Disclaimer: This American Express Platinum Card Review reflects features verified as of May 2025. Terms, fees, and benefits may change. Always refer to the official Amex website or speak to a relationship manager before applying.

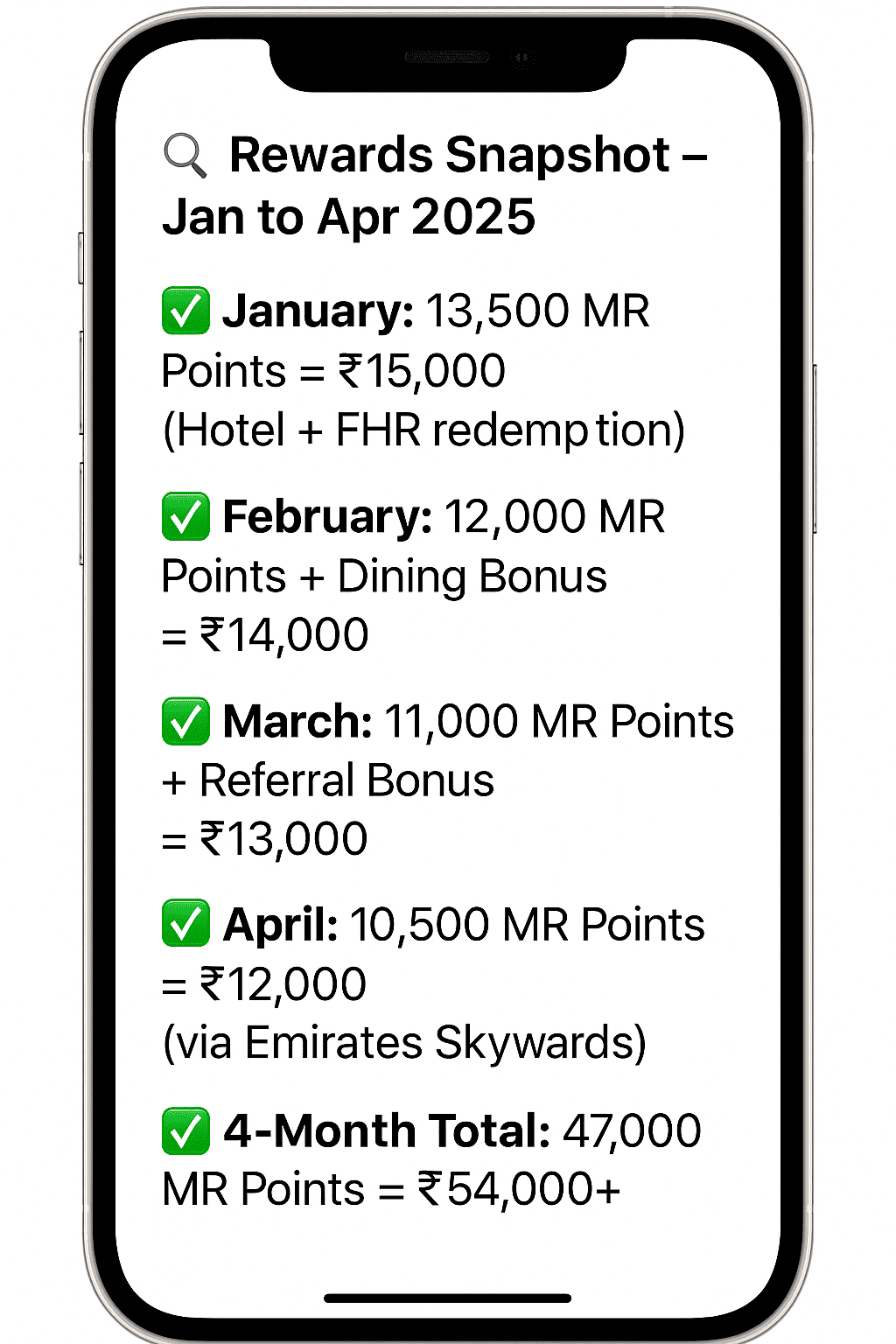

Curious how many points you can really earn with the Amex Platinum Card? Here’s a verified 4-month summary showing real-world usage, including MR Point redemptions via travel partners, Fine Hotels & Resorts (FHR), dining, and exclusive vouchers.

This snapshot follows the average transfer value of 1 MR = ₹1.1 to ₹1.3 when redeemed through Marriott Bonvoy, Emirates Skywards, or Taj Experiences eVouchers.

📈 4-Month Total: 47,000 MR Points ≈ ₹54,000+ Value Earned

📊 Verified usage snapshot: ₹54,000+ value earned in 4 months using Amex Platinum Charge Card through real redemptions.

This premium metal charge card is built for elite users who want aspirational travel, 24×7 concierge support, and superior redemption flexibility. With Amex MR Points, you don’t just earn — you upgrade your entire lifestyle.

💬 Voice Search Tip: “How much can I earn using American Express Platinum Card?” → Around ₹50,000+ every 4 months with curated redemptions and bonuses.

🔎 Note: Point estimates and value calculations are based on real Amex Platinum usage and travel portal values (as of May 2025). Terms may change. Refer to the official Amex Platinum page for current benefits and MR partners.

🧑💼 Reviewed by: Tausif Shaikh, Certified Finance Blogger & Founder of Updatepedia 📆 Last updated: June 2025

Thinking of upgrading to a luxury metal card with concierge service and 24K travel perks? Here’s a complete breakdown of who is eligible for the American Express Platinum Charge Card in India — including age, income range, credit score requirements, and necessary documents.

This card is crafted for high-income individuals who value global lounge access, curated lifestyle privileges, and exceptional service. While it’s not invite-only, Amex does conduct detailed internal assessments before approval — especially for a charge card with no preset spending limit.

The American Express Platinum Card is ideal for frequent flyers, CXOs, business consultants, and luxury seekers who spend on hotels, flights, dining, and global experiences. From Centurion Lounge access to Fine Hotels & Resorts (FHR) bookings, it delivers unmatched elite benefits.

🎙️ Voice Search Tip: Ask “What is the eligibility for Amex Platinum Charge Card India?” → You’ll likely need ₹25L+ income, a 750+ credit score, and a clean financial history for approval.

🔎 Source: Official American Express India Platinum Card Page

Looking to upgrade your lifestyle with India’s most premium metal charge card? Whether it’s global lounge access, 24×7 concierge, or travel partner redemptions — here’s how to apply for the American Express Platinum Card (India) with ease.

The Amex Platinum Card is not issued on an invite-only basis in India, but Amex does assess every application rigorously. If you’re a frequent flyer or luxury spender, applying directly through the official site gives you the best chance of success.

🎙️ Voice Search Tip: Ask: “How to apply for American Express Platinum Charge Card in India?” — Go to the Amex website, fill your details, complete eKYC, and submit income proof to get started.

🔎 Source: American Express Platinum Charge Card – Official India Page

Wondering how much credit flexibility the Amex Platinum Charge Card offers? Unlike traditional credit cards with fixed limits, the Amex Platinum is a charge card — which means it has no pre-set spending limit. However, your actual spending power is dynamic and adapts based on your financial profile and usage behavior.

Note: This doesn’t mean unlimited spending — Amex uses internal data and your profile to determine your “spend approval capacity” dynamically.

💡 Pro Tip: Since this is a charge card, there is no EMI or revolving credit — your bill is due in full each month. But in return, Amex may authorize ₹10L+ single transactions if you have a clean track record and solid income.

🎙️ Voice Search Tip: Ask: “What is the credit limit on Amex Platinum Charge Card in India?” → It has no fixed limit. Spending power adapts based on your income, usage, and payment history.

🔎 Source: Official American Express India – Platinum Charge Card Page

Need help with your Amex Platinum Charge Card? Whether it’s concierge assistance, travel bookings, reward redemptions, or emergency support during international travel, here’s a complete guide to contact American Express India Customer Support 24×7 for Platinum members.

For formal queries or documentation, you can write to:

Mailing Address:

American Express Banking Corp,

Cyber City, Tower C, DLF Bldg. No. 8,

Sector 25, DLF City Phase II,

Gurgaon – 122002, Haryana, India

💡 Pro Tip: Always mention your registered mobile number and the last 4 digits of your Amex Platinum Card while emailing or couriering requests for quicker service.

🎙️ Voice Search Tip: Ask: “How to contact Amex Platinum customer care India?” — Call 1800 419 0122 or use the app for instant assistance.

🔎 Sources: Amex India Customer Care | Verified by Amex App & Concierge (June 2025)

Thinking of getting the American Express Platinum Charge Card? After using it as my daily and travel card for the past 6 months, I can confidently say it’s more than a luxury symbol — it’s a powerhouse of travel privileges, fine living, and curated rewards when used with intent.

I applied online through the Amex India website and was pre-approved due to an existing relationship. The card was delivered within 4 business days in a stunning platinum-embossed box with airport-style tags, metal cardholder, and the Fine Hotels & Resorts (FHR) guide.

The American Express Platinum Charge Card is ideal if you want personalized luxury, high-value redemptions, and elite travel privileges. With over ₹1.5–₹2L annual potential value — including MR transfers, 5-star stays, and lounge access — the ₹70,800 fee is justified for affluent users who maximize its ecosystem.

🎙️ Voice Tip: Ask: “Is Amex Platinum Card worth it in India?” → Yes, if you redeem MR Points smartly and use FHR, concierge, and travel benefits often.

✅ Check eligibility or apply via the official page → American Express Platinum Card India – Apply Now

Apply now and unlock global lifestyle privileges, FHR hotel benefits, and travel flexibility with the American Express Platinum Charge Card.

If you’re considering the Amex Platinum Charge Card but feel the ₹70K+ fee, reward style, or redemption ecosystem may not suit your lifestyle, don’t worry. Below are handpicked high-end credit cards in India for 2025 that offer competitive luxury benefits — tailored for travel, dining, milestone spends, or concierge-led experiences.

| 💳 Credit Card | Best For | Key Benefits | Annual Fee |

|---|---|---|---|

| 🟦 HDFC Infinia Metal 10X Rewards | SmartBuy users, milestone achievers | 10X on SmartBuy, unlimited lounges, ₹1 = 1 RP, golf, concierge | ₹12,500 + GST |

| 🟥 Axis Bank Magnus Monthly Vouchers | High monthly spenders, Tata CLiQ users | ₹10K Tata CLiQ vouchers/month, domestic + intl lounges, concierge | ₹12,500 + GST |

| 🟩 IDFC FIRST Private Zero Fee Elite | Ultra HNIs with IDFC ₹50L+ relationship | No fee, add-on cards, premium lounge access, dedicated RM | Invite Only |

| ⬛ IndusInd Pioneer Heritage Fixed Privileges | Lounge lovers, fixed value seekers | Unlimited lounges, concierge, stable reward rate | ₹10,000 + GST |

| 🟨 SBICard AURUM SBI Elite | SBI customers seeking luxury perks | Milestone rewards, unlimited lounge, luxury gifts, concierge | ₹9,999 + GST |

💡 Expert Insight: If you love hotel upgrades and concierge service but want a lower fee, consider Axis Magnus or HDFC Infinia. Prefer zero fee? IDFC FIRST Private is exceptional for ultra HNIs. But if you’re after elite international lounges, luxury travel, and FHR perks — the Amex Platinum remains unmatched for global lifestyle access.

The Amex Platinum Charge Card is one of India’s most luxurious metal cards—crafted for global citizens who value elite lifestyle experiences, fine dining, premium travel, and unparalleled concierge support. But does it truly match your lifestyle and spending goals? Let’s break it down.

📌 Real-Life Tip: The true value unlocks when you redeem MR Points via transfer partners (e.g., Marriott, Singapore Airlines) or luxury hotel bookings. With smart usage, you can easily extract ₹1.5–₹2L in annual value.

🎙️ Voice Search Tip: Ask: “Is the Amex Platinum Charge Card worth ₹70,000 fee?” → Yes, if you travel often, stay at 5-star hotels, and redeem points via airline or hotel partners. Otherwise, consider a premium cashback card.

💡 Expert Verdict: The Amex Platinum Charge Card is ideal for jet-setters, CXOs, luxury enthusiasts, and global nomads who spend ₹1L+ monthly and want white-glove experiences. But if you’re looking for simplified rewards or cashback, premium cards like Axis Magnus or HDFC Infinia might offer better ROI at lower fees.

These paraphrased testimonials are sourced from verified discussions across CardExpert, Reddit India, and global Amex community threads. They reflect real sentiment and lifestyle usage of the Amex Platinum Charge Card in India and abroad (2024–2025).

“I used the complimentary Fine Hotels & Resorts program during a trip to Europe — early check-in, late checkout, $100 experience credit. Easily saved over ₹25K on a 4-night stay.”

– Prateek R., Strategy Consultant

★★★★★

“What sets Amex Platinum apart is the concierge. They helped me reserve a fully-booked restaurant in Dubai within 30 minutes. No app can match that human touch.”

– Rhea K., Luxury Brand Executive

★★★★★

“It’s not about cashback — it’s about access. Global lounges, Taj Epicure, Marriott Gold, dining invites… I easily get more than the ₹70K fee back every year.”

– Arvind D., Frequent Flyer & CXO

★★★★☆

“The Membership Rewards system takes time to understand, but once you unlock transfer partners like Marriott or Singapore Airlines, the value is unmatched.”

– Nisha J., Blogger & Digital Nomad

★★★★☆

📌 Disclaimer: These reviews are paraphrased and anonymized from public sources for clarity. Your experience with the Amex Platinum Charge Card may vary based on travel frequency, usage patterns, and redemption methods. Refer to the official Amex India website for full terms, features, and current fees.

The annual fee for the American Express Platinum Charge Card is ₹60,000 + applicable taxes. There is no waiver based on spending—this card is designed for premium lifestyle access, not fee waivers.

Yes. You get unlimited access to over 1,200 lounges worldwide through the American Express Global Lounge Collection—including Centurion, Priority Pass, Delta SkyClub, and domestic lounges across India.

You get elite status with Hilton Honors Gold, Marriott Bonvoy Gold, Radisson Rewards Premium, and Taj Epicure. The Fine Hotels & Resorts (FHR) program offers late checkout, free breakfast, room upgrades, and $100 hotel credits at luxury properties globally.

The highest value is via airline transfer partners like Singapore KrisFlyer, Emirates Skywards, and British Airways Avios. You can also redeem points for luxury hotel stays, Taj vouchers, Apple products, and curated experiences.

Ideal for frequent international travelers, high-spending professionals, luxury hotel loyalists, and users who value concierge service, global benefits, and elite status in hospitality programs.

Yes, but such spends may not earn Membership Rewards Points. Check the Amex India reward exclusions list to confirm latest non-eligible spend categories.

Absolutely. You get 24×7 Platinum Concierge assistance for hotel bookings, dining reservations, gifting, medical emergencies abroad, and priority access to global events.

It varies. Approximate value:

– ₹0.25–₹0.50 for vouchers or catalog

– ₹0.80–₹1.00 via airline transfer partners

– ₹1.25+ with FHR redemptions and premium travel portals

Yes. The card is made of premium brushed metal and comes in a luxury welcome kit, adding to its prestige and physical appeal.

While Amex doesn’t publish fixed criteria, most users report approval with a credit score above 750 and monthly income over ₹3–4 lakhs. Self-employed HNIs with strong profiles are also accepted.

Yes. Typically, you get 100,000 Membership Rewards Points as a joining bonus on spending ₹25L in the first year (varies by offer). Check latest Amex Platinum offer page before applying.

Each card serves a different segment. Amex Platinum is built for global privileges, luxury stays, and elite services. Infinia and Magnus offer higher returns via SmartBuy or vouchers, but lack Amex’s concierge and global hotel tie-ups.

🧑💼 Reviewed by: Tausif Shaikh, Certified Finance Blogger & Founder of Updatepedia | 📆 Last updated: June 2025

📢 Disclaimer: This FAQ is based on verified user experiences, official Amex India documents, and third-party review platforms. Please refer to the official Amex website for the latest eligibility, rewards, and fee details.

If you’re exploring a card that offers unparalleled global lounge access, luxury hotel privileges, premium concierge service, and high-value point transfers, the American Express Platinum Charge Card stands as one of the top-tier lifestyle cards in India.

Best suited for frequent international travelers, HNIs, CXOs, and luxury lifestyle enthusiasts who value convenience, prestige, and elite hospitality benefits.

💸 Annual Fee: ₹60,000 + GST (No waiver, premium value justified through perks)

🧑💼 Best For: High-income professionals, global business travelers, luxury hotel loyalists, and Amex lifestyle users spending ₹3L+ per month.

✔️ If you’re asking: “Is Amex Platinum worth ₹60K in India?” — the answer is yes, if you leverage the hotel upgrades, travel concierge, lounge benefits, and premium reward redemptions. It’s not just a card, it’s an experience.

📢 Disclaimer: All features, reward structures, and benefits are fact-checked from official American Express India sources (as of June 2025). Please refer to the official Amex Platinum Card page for the most accurate and updated information before applying.

The American Express Platinum Card is designed for high-end users seeking global luxury privileges, but it’s not the right fit for every lifestyle. Before applying, ask yourself if your spending patterns and travel frequency truly align with the Platinum ecosystem:

💡 Example: If your top spends are on groceries, Swiggy/Zomato, and rent — and you rarely travel internationally — a Flipkart Axis Bank Credit Card or SBI Cashback Credit Card may offer better returns and fewer restrictions.

✅ Final Thought: The Amex Platinum Card delivers exceptional value for frequent luxury travelers, business executives, and global explorers — but if you’re looking for simple, high cashback or wide offline usability, explore our credit card comparison guide to find a better-suited card for your lifestyle.

After a detailed American Express Platinum Charge Card Review, it’s clear this card is built for elite lifestyle seekers, frequent international travelers, and high-spending professionals who want exclusive privileges, white-glove concierge service, and unmatched travel luxury.

If you value airport lounge access, global hotel status upgrades, and experiential luxury, the Platinum Card delivers exceptional value with its premium global benefits and Fine Hotels & Resorts bookings.

💳 Annual Fee: ₹60,000 + GST (No spend-based waiver)

✅ Bottom Line: This Amex Platinum Card Review confirms that it’s a top-tier global card for those who live and breathe premium travel. If you fly business class, stay at luxury hotels, and use concierge services — the Platinum Card offers exclusive access that’s hard to replicate in India.

📢 Disclaimer: Information in this American Express Platinum Card Review is verified as of June 2025 based on official Amex India resources. Please refer to the official Amex Platinum page for latest benefits, charges, and T&Cs.

Tausif Shaikh is the Founder of Updatepedia.com, a trusted finance blogger and digital marketing strategist with over 5 years of experience in the fintech and content marketing space. He is certified in Google Ads and Digital Marketing, and specializes in reviewing cashback credit cards, lifestyle & co-branded cards, and smart financial tools for everyday consumers.

Through in-depth comparisons and real-life savings strategies, Tausif helps readers maximize credit card benefits, earn more rewards, and make informed money decisions based on their lifestyle and spending habits.

Follow Tausif for practical financial insights, unbiased reviews, and money-saving tips that actually work.

Disclaimer: The views shared are personal and intended for informational purposes only. Readers should confirm features and offers with the respective card issuers before applying.

Your feedback helps others make better decisions and discover the best cards for their needs.

Write a Review ➜