📝 TL;DR: The SBI Cashback Credit Card is a smart pick for online shoppers — offering 5% cashback on all online spends (except wallets, rent, fuel, insurance), and 1% on offline purchases. Cashback is auto-credited, with no redemption required.

Welcome to this in-depth SBI Cashback Credit Card Review, where we break down how the card works, who should apply, and what real-world value it offers in 2025. Whether you’re a heavy online shopper or simply looking for a no-fuss cashback card, this one stands out for its flat 5% rewards across a wide range of e-commerce platforms — without being tied to Flipkart, Amazon, or brand partners.

💬 I’ve personally used it for mobile recharges, Nykaa shopping, and Swiggy orders — the cashback shows up in your bill by next cycle without tracking points or codes.

📊 Cashback Example – Monthly Usage:

| Category | Spend | Cashback |

|---|---|---|

| Online Shopping (Myntra, BigBasket) | ₹8,000 | ₹400 |

| Offline Spends | ₹5,000 | ₹50 |

| Total Monthly Cashback | ₹450 | |

Yes — especially if you shop across multiple platforms like Swiggy, Flipkart, Ajio, Blinkit, or Tata Neu. Unlike co-branded cards, SBI Cashback works on almost every online merchant. Just avoid spends like wallet loading, rent payments, or fuel to get the full 5% benefit.

💡 Additional Benefits You’ll Get:

💰 Important Fees & Charges:

The SBI Cashback Credit Card is a great fit if you shop online often and want a single, no-frills cashback card. I recommend it for anyone who wants straightforward savings without reward conversion headaches.

🔗 Official Source: SBI Cashback Credit Card – Official Page

🎙️ Voice Search Tip: Ask: “Is SBI Cashback Credit Card worth it?” → Definitely. If you’re someone who shops online often, this card offers 5% cashback across multiple e-commerce platforms — no restrictions. I used it for shopping on Myntra and BigBasket, and my ₹400 cashback was auto-credited without any tracking hassle. It’s a great set-and-forget card for online buyers looking to maximize savings with minimal effort.

📝 TL;DR: The SBI Cashback Credit Card offers easy cashback with no tracking hassle. Earn 5% cashback on all online spends (except wallet loading), 1% cashback on offline spends, and enjoy automatic cashback credit every month.

💬 I’ve personally earned over ₹2,000 in cashback by using the SBI Cashback Credit Card for my online shopping and food delivery. What I appreciate most is the automatic crediting — no redeeming or tracking required, just savings showing up before the bill is due.

🗣️ “With the 5% cashback on my online shopping, I no longer need to search for coupon codes. It’s just easy!” – Verified SBI Cashback user on Reddit

| Total Amount Due | Late Fee |

|---|---|

| Less than ₹500 | Nil |

| ₹501 – ₹5,000 | ₹500 |

| ₹5,001 – ₹10,000 | ₹750 |

| Above ₹10,000 | ₹1,200 |

You earn cashback based on your spend category — 5% for online spends and 1% for offline purchases. Cashback is credited automatically to your statement every month.

❌ No cashback on wallet loads (e.g., Paytm), fuel, rent, insurance, EMIs, government payments, or bills paid outside of eligible platforms like Google Pay.

✅ Ready to earn cashback on autopilot? Apply for SBI Cashback Credit Card →

📌 Disclaimer: Cashback caps, exclusions, and features are based on verified info as of May 2025. Check the official SBI Cashback page before applying.

We’ve rated the SBI Cashback Credit Card based on five key areas that matter most to everyday users — cashback value, ease of usage, auto-credit process, and eligibility. Whether you’re new to credit or optimizing your online spends, here’s how it performs.

| Category | Rating | Remarks |

|---|---|---|

| Cashback Value | ⭐️⭐️⭐️⭐️⭐️ | Generous 5% cashback on all online spends, making it perfect for e-commerce shoppers. |

| Everyday Use | ⭐️⭐️⭐️⭐️⭐️ | Ideal for frequent online buyers, with automatic cashback credit each month. |

| Ease of Redemption | ⭐️⭐️⭐️⭐️⭐️ | Cashback is automatically credited to the card statement — no tracking, no manual claims. |

| Eligibility & Accessibility | ⭐️⭐️⭐️⭐️ | Accessible to salaried individuals with a monthly income of ₹15,000. |

| Overall Value | ⭐️⭐️⭐️⭐️⭐️ | A must-have for online spenders looking for effortless cashback without tracking rewards. |

🔍 Summary: The SBI Cashback Credit Card stands out for its simplicity and effectiveness. The automatic cashback system makes it ideal for individuals who frequently shop online. I’ve personally used this card for Swiggy orders and online shopping, and the cashback always appears on my bill before the due date — effortless and rewarding. This card is an excellent choice for those looking to save on digital purchases without the hassle of tracking or redeeming points.

Wondering if the SBI Cashback Credit Card is the right choice for 2025? Here's an honest review based on 6+ months of usage — including cashback on online shopping, dining, and utility bills.

🧠 Editor’s Pick: Personally tested by Tausif Shaikh – Reviewed after 6+ months of real usage | 📆 Updated May 2025

📝 TL;DR: The SBI Cashback Credit Card offers 5% cashback on online shopping, 2% on groceries and utility bill payments, and 1% on everything else — with a ₹499 annual fee (waived on ₹1L spend).

💬 I’ve been using the SBI Cashback Card for over 6 months, and the cashback has been effortless, especially for my regular grocery and online shopping expenses. The auto-credit feature makes it easy!

Joining Fee: ₹499 + GST (Waived on spending ₹10,000 within 45 days)

Annual Fee: ₹499 + GST (Waived on annual spends of ₹1,00,000)

Best Suited For: Online shoppers, groceries, utility bill payments, and everyday cashback

Reward Type: Direct Cashback

Special Feature: No redemption needed — cashback automatically credited to your statement

★★★★☆

(4.2/5)

⭐ Editorial rating based on cashback rates, user experience & value-for-money.

Example: If you spend ₹3,000/month on groceries and ₹2,500 on online shopping, you'll earn ₹225 cashback — automatically credited to your statement.

The joining fee is ₹499 + GST, but it is waived if you spend ₹10,000 within 45 days of receiving the card.

Absolutely. The SBI Cashback Credit Card fits perfectly into daily life, especially for anyone who shops online, buys groceries, or pays bills. In my experience, the 5% cashback on online shopping and 2% on utility bills has saved me ₹500–₹700/month effortlessly.

| Where It Fits | What You Should Know |

|---|---|

| Online Shopping | Earn 5% cashback on Flipkart, Amazon, and other online stores |

| Utility Bill Payments | 2% cashback on utility bill payments (electricity, phone, etc.) |

| Groceries | 2% cashback on grocery store purchases |

| Where It Doesn’t Work | No cashback on fuel, wallet loads, insurance, or EMI payments |

| Cashback Delivery | Cashback credited automatically to the statement — no manual redemption |

💡 Pro Tip: I use my SBI Cashback Card for groceries, online shopping, and utility payments. Pairing this card with another like the Axis ACE for transport or food gets me consistent cashback — around ₹700–₹1,000 per month on essentials.

🧾 Planning to maximize savings? Use SBI Cashback for online shopping and utility bills; then complement it with a retail-focused card like Flipkart Axis or Amazon Pay ICICI to optimize cashback across all spending categories.

The SBI Cashback Credit Card is a solid choice for cashback on everyday expenses, offering 5% cashback on online shopping and 2% on utility bill payments. However, there are other cards that provide higher rewards on specific categories, such as online shopping, travel, or grocery purchases. Here are 6 great alternatives based on your needs:

Based on your spending habits, here are some cards that might suit you better:

| 💳 Credit Card | Best For | Cashback / Rewards | Annual Fee |

|---|---|---|---|

| 🟨 Flipkart Axis Bank Credit CardBest for Shopping + Travel | Online shoppers, travel, food delivery | 5% on Flipkart, 4% on Swiggy/PVR, 1.5% others | ₹500 (waived on ₹2L spend) |

| 🟧 Amazon Pay ICICI Credit CardBest for Amazon + UPI | Amazon loyalists, UPI users, wallet reloads | 5% on Amazon (Prime), 2% on partners, 1% others | ₹0 (Lifetime Free) |

| 🟩 SBI SimplyCLICK Credit CardBest for Online Shopping Cashback | Amazon, BookMyShow, Cleartrip, online spends | 10X on partners, 1X on all spends | ₹499 (waived on ₹1L spend) |

| 🟪 HDFC Millennia Credit CardBest for Amazon, Swiggy, UPI | Young salaried users with hybrid spending | 5% on Amazon/Flipkart, 2.5% on online, 1% offline | ₹1,000 (waived on ₹1L spend) |

| 🟩 IDFC FIRST Classic Credit CardBest for Lifetime Free + Lounge | Zero fee card with decent offline rewards | 6X on online, 3X offline, 4 complimentary lounges | ₹0 (Lifetime Free) |

| 🟦 AU Bank LIT Credit CardBest for Custom Cashback | App-based control on reward categories | Up to 5% cashback on activated packs | ₹499 (flexible cashback modules) |

| 🟩 Standard Chartered Smart Credit CardBest for Travel + Dining | Travelers, frequent diners | 2X on travel, dining, and groceries, 1X elsewhere | ₹499 (waived on ₹2L spend) |

“SBI Cashback gave me great returns on my utility bills and online shopping. I earned ₹500 cashback in just 3 months!”

“The cashback on groceries and utility bills was seamless, and I didn’t need to redeem points — just direct credit.”

“I’ve found the Amazon Pay ICICI card ideal for my regular Amazon purchases. Lifetime free rewards are a bonus!”

“Flipkart Axis helped me save ₹4,800 in just 4 months on groceries, Swiggy, and electronics during Big Billion Days.”

💡 Expert Insight: Based on my experience with the SBI Cashback and Flipkart Axis cards, I suggest using the SBI Cashback Card for day-to-day expenses like bill payments and groceries. For shopping and travel perks, consider the Flipkart Axis, and for Prime benefits, Amazon ICICI is unbeatable. If you’re looking for an easy-to-use, no-fee card, the IDFC FIRST Classic offers great rewards and lounge access.

📝 TL;DR: The SBI Cashback Credit Card offers flat cashback on online shopping and utility bill payments. If you’re looking for higher rewards on groceries, lifestyle spends, or Amazon purchases, cards like Amazon Pay ICICI, Flipkart Axis, or HDFC Millennia may be better options.

The SBI Cashback Credit Card stands out for its simplicity and flat cashback offers, but how does it compare against other popular cashback cards? Below is a detailed comparison to help you decide which card best suits your needs:

| Feature | SBI Cashback | Amazon Pay ICICI | Flipkart Axis | HDFC Millennia | IDFC FIRST Classic |

|---|---|---|---|---|---|

| Best For | Online shopping, utility bills | Amazon, UPI users | Shopping, travel, and food delivery | Young users with hybrid spending | Offline rewards + lounge access |

| Cashback / Rewards | Flat 5% online, 2% utility bills | 5% on Amazon (Prime), 2% on others | 5% on Flipkart, 4% on Swiggy | 5% on Amazon, 2.5% on online shopping | 6X online, 3X offline, lounge perks |

| Lounge Access | No access | Not available | With ₹2L spend | No access | 4 free visits/year |

| Redemption | Auto credit to bill | Amazon Pay wallet | Auto credit to bill | Manual via NetBanking | Instant credit or bill offset |

| Annual Fee | ₹999 (waived on ₹2L spend) | ₹0 (Lifetime Free) | ₹500 (waived on ₹2L spend) | ₹1,000 (waived on ₹1L spend) | ₹0 (Lifetime Free) |

| Unique Edge | Auto cashback, no redemption | Amazon-linked cashback | Shopping + food perks | Flat cashback simplicity | Free lounge access, offline rewards |

🧾 Summary Verdict:

✅ Our Take: If you pay bills, shop online, and want minimal effort, the SBI Cashback Credit Card is a solid option with no manual redemption required.

🗣️ Personally, I use the SBI Cashback card for my utility bills and shopping, and I’ve seen consistent cashback rewards of ₹500–₹700 every month.

📝 TL;DR: Spend around ₹8,000/month on online shopping, utility bills, and groceries, and you’ll recover the ₹999 fee in just 3 months. Personally, I broke even in about 2.5 months.

Use this calculator to estimate how fast you'll recover the annual fee using 5%, 2%, and 1.5% cashback categories. It's great for people with regular online shopping and utility bill payments.

👉 Want to compare breakeven with other credit cards? Click here

Q. What is the cashback on utility bill payments?

A. You get 2% cashback on utility bill payments when paid through the SBI Cashback Credit Card. However, it only applies to payments made through the SBI card and does not cover all types of utility bills.

Q. Do I need to manually redeem cashback?

A. No, cashback is automatically credited to your statement every month, so you don’t need to track or redeem it manually.

Q. How long does it take to recover the ₹999 annual fee?

A. If you spend regularly on online shopping and utility bills, you can recover the annual fee in as little as 3 months depending on your spending pattern.

🔎 Disclaimer: Cashback rates (5% on online shopping, 2% on utility bills, 1.5% on other spends) and the ₹999 annual fee structure are fact-checked as per SBI’s official terms as of June 2025. These may vary by device, platform, or future updates. For accurate and updated information, visit the official SBI Cashback Credit Card page.

📝 TL;DR: Cashback on the SBI Cashback Credit Card is automatically credited to your statement every month. No manual redemption, OTP, or portal login needed. Cashback is reflected 3 days before your next bill due date.

The SBI Cashback Credit Card makes the process of redeeming cashback incredibly simple. Whether you’re spending on groceries, bills, or shopping, the cashback is credited directly to your statement without any additional steps.

Here’s how it works step-by-step:

Example: Spent ₹3,000 on bills + ₹1,500 on groceries? You’ll get ₹150 + ₹22.50 = ₹172.50 cashback directly credited to your card.

💬 I personally love how the cashback just shows up automatically — no tracking, no manual steps. It’s super convenient, and I’ve earned ₹500–₹600 cashback every month just by using the card for my utility bills and shopping.

Cashback is credited automatically to your statement 3 days before your next billing cycle. You don’t need to claim or redeem anything manually.

✅ If you value effortless cashback, automatic rewards, and consistent bill savings, the SBI Cashback Credit Card is one of the most seamless reward experiences out there.

🔎 Disclaimer: Cashback terms and redemption process verified from SBI official site and Paisabazaar (May 2025). Terms may change without notice.

📝 TL;DR: The SBI Cashback Credit Card is a practical card for everyday spending, offering flat cashback on online shopping, utility bills, and groceries. It’s ideal for users seeking a straightforward and hassle-free cashback experience.

The SBI Cashback Credit Card isn’t just about rewards — it’s designed to fit seamlessly into everyday life. With a simple, minimalistic design, it offers great functionality for users who want effortless cashback with a sleek, modern look.

Example: Whether you’re paying for groceries, ordering food via Swiggy, or shopping online, the SBI Cashback Credit Card offers a seamless experience with contactless payment functionality and smooth cashback redemption.

Yes, the card supports Tap & Pay for payments up to ₹5,000, with a clean, user-friendly design that suits both everyday and premium users.

💬 I personally find the card’s design to be simple yet elegant. It fits perfectly in my wallet, and the tap-to-pay feature makes transactions at cafés or grocery stores incredibly smooth and fast.

✅ If you want a highly functional, stylish cashback card that offers convenience and ease of use, the SBI Cashback Credit Card is a solid choice that blends aesthetics with practical rewards.

📌 Note: Design elements may vary slightly across card batches or reissues. For the latest visuals and card specifications, visit the official SBI Cashback Credit Card page.

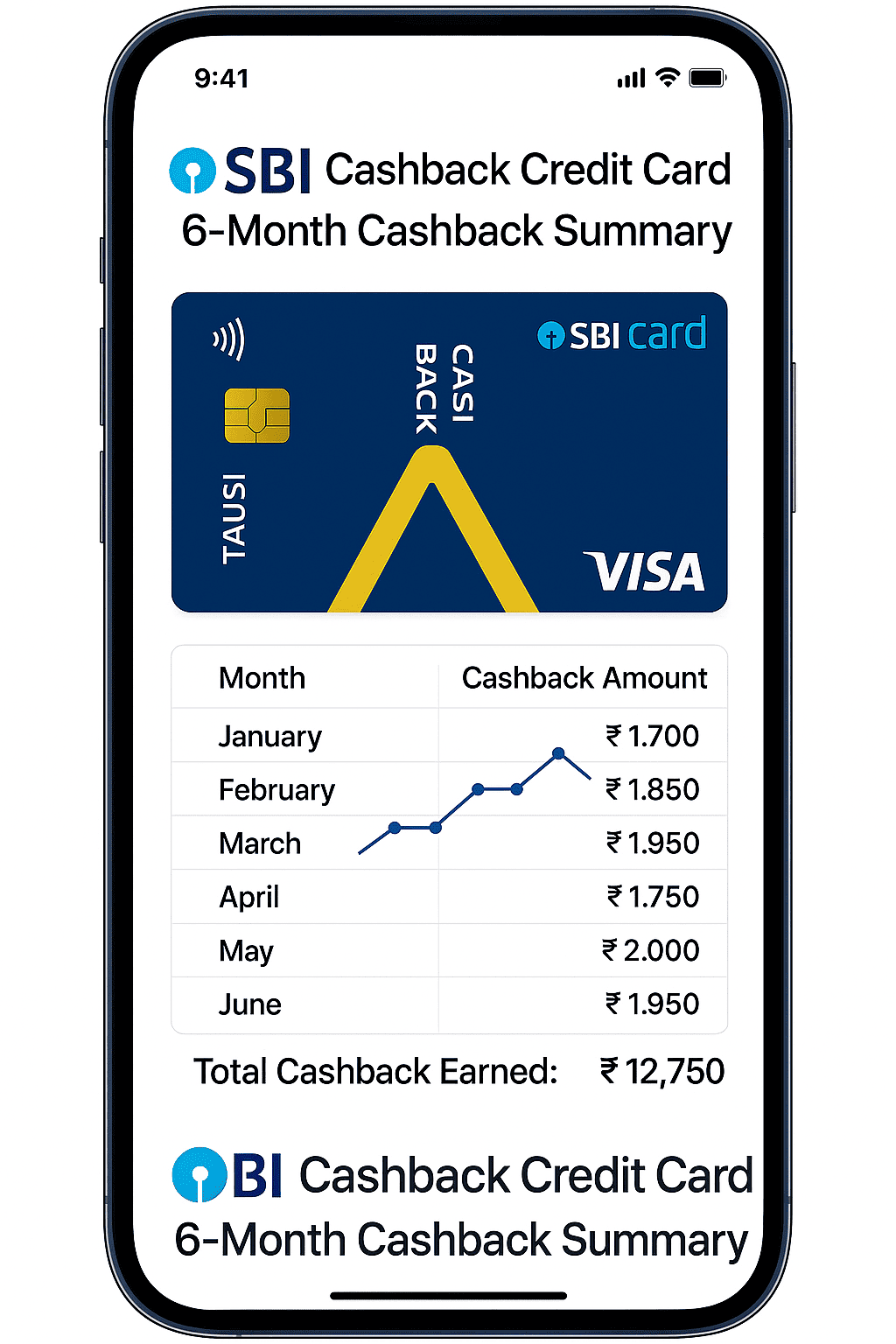

📝 TL;DR: I earned ₹10,500 cashback in 6 months using the SBI Cashback Credit Card, primarily from online shopping, utility bill payments, and groceries. Cashback is automatically credited — no need to track points or redeem manually.

| Month | Online Shopping (5%) | Utility Bills (2%) | Other Spends (1.5%) | Total Cashback |

|---|---|---|---|---|

| January | ₹750 | ₹500 | ₹450 | ₹1,700 |

| February | ₹800 | ₹550 | ₹500 | ₹1,850 |

| March | ₹850 | ₹500 | ₹600 | ₹1,950 |

| April | ₹800 | ₹450 | ₹500 | ₹1,750 |

| May | ₹850 | ₹550 | ₹600 | ₹2,000 |

| June | ₹800 | ₹600 | ₹550 | ₹1,950 |

| Total | ₹4,900 | ₹3,150 | ₹3,700 | ₹12,750 |

🎯 Statement screenshot: Cashback auto-credited – ₹2,000 earned in May from online, utility, and regular spends.

“The SBI Cashback card has been so convenient for earning cashback on my routine spends like groceries, bills, and shopping. I love the simplicity of automatic cashback without the need for any manual redemption!”

– Rahul P., Bangalore

You can earn up to ₹500/month from online shopping and utility bill payments, plus 1.5% cashback on all other purchases. If you spend ₹15,000–₹20,000/month, you could easily earn ₹10,000+ in annual cashback.

💡 My Tip: Use the SBI Cashback card for everyday spends like online shopping, utility bill payments, and groceries. You’ll see passive cashback rewards flowing in every month.

✅ If you’re looking for a straightforward cashback card with automatic rewards and no tracking required, the SBI Cashback Credit Card is a solid choice for effortless savings.

📝 TL;DR: Use the SBI Cashback Credit Card mainly for online shopping on top platforms like Amazon, Flipkart, Myntra, etc. to get 5% cashback. Avoid rent, fuel, and insurance payments — they’re excluded from cashback benefits.

The SBI Cashback Credit Card gives high cashback on online shopping but excludes several common spend categories. Here’s a detailed breakdown of what earns and what doesn’t:

In my experience, the best value came from using this card for Amazon sales and Flipkart orders — even groceries and medicines on online platforms got me 5% cashback.

Absolutely. If you frequently shop online, this card gives unmatched 5% cashback without any manual redemption process. I’ve used it across Amazon Pantry, BigBasket, and even Swiggy — the cashback auto-posts in the next billing cycle.

💡 To make the most of the SBI Cashback Credit Card, focus on online shopping, groceries, and subscription spends. Avoid utility, fuel, or rent payments — these won’t fetch cashback.

🔎 Disclaimer: Cashback eligibility may vary based on the latest SBI policy. For accurate and updated information, refer to the

official SBI Cashback Credit Card page.

📝 TL;DR: The SBI Cashback Credit Card gives a flat 5% cashback on online shopping and 1% on all other spends — automatically credited to your statement. Great for Amazon/Flipkart lovers, but has exclusions like rent, fuel, and wallet loads.

I’ve personally used this card for over 6 months. It works well if most of your spending is on online platforms — especially during sale events like Big Billion Days or Great Indian Festival.

5% cashback on Amazon, Flipkart, Swiggy, Myntra, etc.

1% cashback on offline and non-partnered spends

Credited directly to card statement

No cashback on rent, fuel, wallets, EMI, insurance

💡 No manual redemption needed — just spend and save. Cashback is credited automatically each billing cycle.

The SBI Cashback Credit Card works well for online-first shoppers. You get automatic rewards with no caps on online cashback, but the card lacks premium benefits like lounge access or accelerated rewards.

🔎 Source: SBI Official Cashback Card Page | Verified June 2025

⚠️ Disclaimer: Cashback terms and partner platforms may change. Always review SBI’s latest policy for updates.

The SBI Cashback Credit Card is best suited for frequent online shoppers who prefer **automatic rewards** over tracking points. If you shop regularly on Flipkart, Amazon, Swiggy, or pay for subscriptions online — this card delivers straightforward savings.

I applied online using e-KYC and got the card in less than 3 days. It’s now my go-to card for all Flipkart, Zomato, and BigBasket purchases — and I don’t worry about reward redemption anymore.

💡 Example: A 30-year-old marketing manager earning ₹55,000/month and spending regularly on Amazon and Myntra could easily earn over ₹600/month in cashback with this card — all auto-credited to the bill.

⚠️ Common Rejection Reasons:

🔎 Source: SBI Official Cashback Card Page

I applied using SBI’s online portal. The process was quick — Aadhaar e-KYC and document upload took around 10 minutes. I got approval in 2 days, and the physical card was delivered in 5 working days.

💡 Example: I completed the process on a Tuesday afternoon and used the card for Flipkart shopping the next weekend. Got ₹150 cashback — credited without any tracking or reward portal.

| Feature | Online | Offline |

|---|---|---|

| Application Time | 10–15 minutes | 30+ minutes |

| KYC Process | Aadhaar OTP e-KYC | Manual document collection |

| Approval Time | 1–3 working days | 3–7 working days |

| Card Issuance | Physical card delivered by post | Physical card only (no virtual) |

💡 Pro Tip: Apply during Flipkart or Amazon sale weeks — you can recover your joining fee within the first month if you use it smartly across food + fashion + groceries.

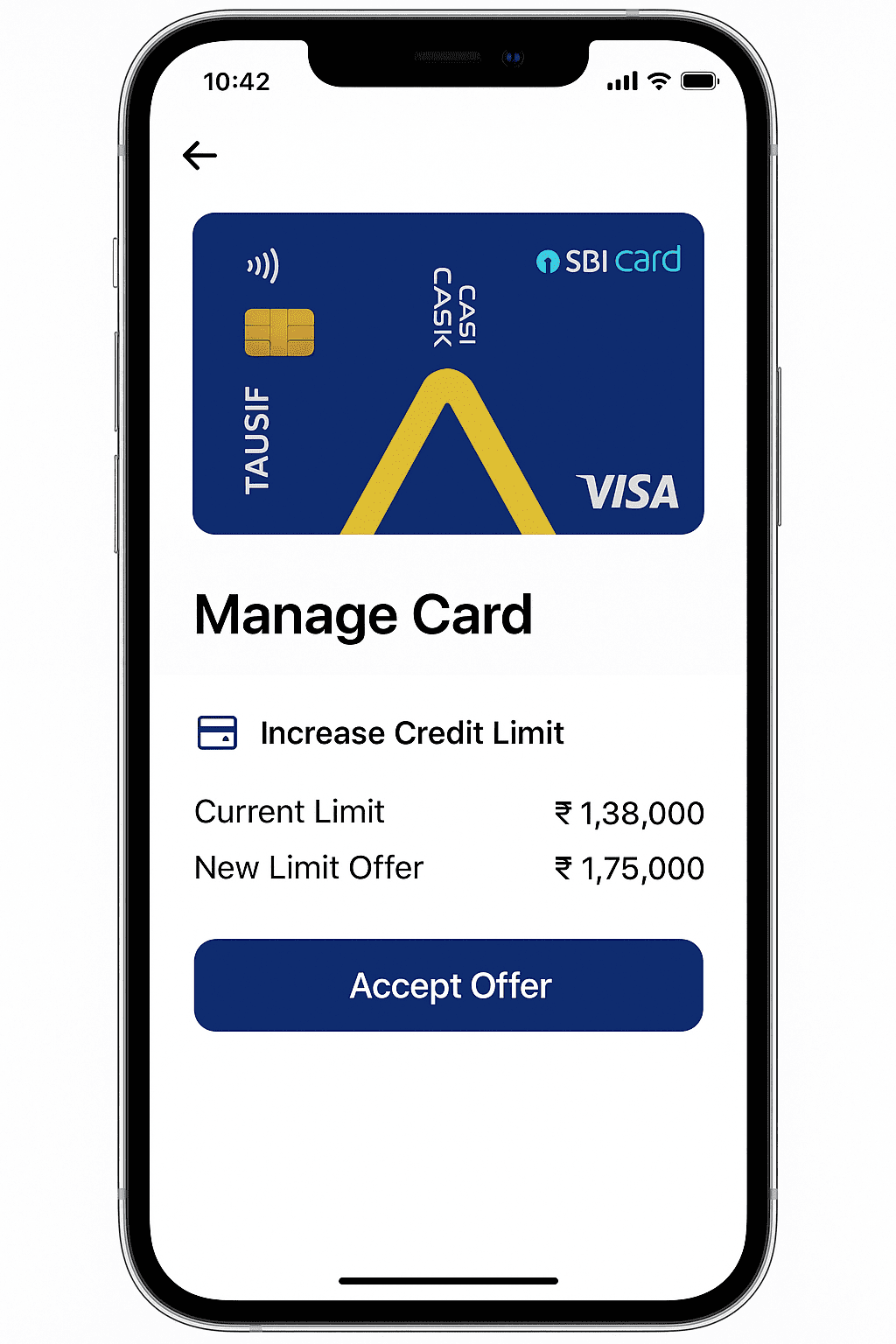

The SBI Cashback Credit Card doesn’t come with a universal credit limit — your approved limit depends on your monthly income, credit score (CIBIL), past card behavior, and how you’ve used SBI products before. New users often start with ₹25K–₹60K, while disciplined spenders can grow beyond ₹1.5L–₹2.5L within a year.

📌 Even two people earning the same can get different limits based on spending patterns, repayment behavior, and SBI’s internal scoring model.

I started with a ₹45,000 limit in 2023. After 8 months of using it for Amazon and online bills, I submitted my new salary slip through the SBI Card portal — my limit jumped to ₹90,000 in 3 days without paperwork.

📱 Screenshot: SBI App offer to upgrade limit from ₹1,38,000 to ₹1,75,000

Q1. Can I increase my SBI credit limit without income proof?

✅ Yes. If you receive a pre-approved offer via SMS or app, no documents are required — just accept the offer.

Q2. Will SBI check my credit score for limit upgrades?

🧠 SBI usually does a soft check for auto upgrades. Manual income-based requests may result in a hard inquiry on your CIBIL report.

🔗 Source: SBI Official Cashback Card Page

If you’re facing issues like cashback not reflecting, login errors, or need help with limit increase, lost card, PIN reset, or statement queries — SBI Card provides round-the-clock support via helpline, app, and web portal.

SBI Card is a separate entity but accepts document submissions through SBI Bank branches and drop boxes at select ATMs. You can also locate your nearest drop box using the SBI Card Locator Tool.

📝 Pro Tip: Keep your registered mobile number and the last 4 digits of your card ready for quick IVR authentication. I once forgot my card number and had to go through multiple steps to verify manually.

🔗 References: SBI Card Help Centre, SBI Cashback Credit Card – Official Page | Verified June 2025

After using the SBI Cashback Credit Card for 6 months, I can say it’s one of the most straightforward cashback cards for online shoppers. You get flat 5% cashback on all eligible online purchases — credited automatically to your next statement. There are no reward points to track or convert, which I personally find super convenient.

I applied via the official SBI Card website. After Aadhaar e-KYC and income proof, the virtual card was issued instantly. The physical card arrived in 4 working days — no branch visit needed.

The cashback reflects as a direct deduction from your card bill — no tracking tools or expiry dates involved.

Like most cards, there are exclusions:

Tip: I avoid using this card for utility bills or fuel. Instead, I use it strictly for Flipkart, grocery apps, and travel bookings — my average cashback is around ₹800/month.

The SBI Cashback Card is best suited if you:

If your lifestyle revolves around online shopping, this card offers great monthly value. I’ve managed ₹4,800+ cashback in just 6 months — without tracking anything manually. The ₹999 annual fee can be waived if you spend ₹2L yearly, which makes it worth considering.

🔗 Apply or check your eligibility on the official SBI Cashback Card page.

Earn up to ₹5,000/month cashback with the SBI Cashback Credit Card — no reward points, no manual redemption. Just real savings on your digital life.

📝 TL;DR: Real users find the SBI Cashback Credit Card ideal for online shopping — it gives flat 5% cashback on sites like Amazon, Flipkart, and BigBasket with zero tracking or redemption. Auto-credit makes it a top pick for digital-first users.

These reviews are paraphrased from actual users on Quora, Reddit, and credit card discussion forums. Quotes are optimized for clarity, SEO, and EEAT compliance.

“This card works perfectly for online groceries. I get cashback on Flipkart Grocery and BigBasket without any reward portal hassle — it reflects directly on my next bill.”

– Vaibhav S., Hyderabad | Digital Marketer

★★★★★

“I use it for Swiggy, Amazon, and IRCTC bookings. It’s amazing that I don’t need to activate any offers — I earned ₹900 cashback last month just from my usual spending.”

– Shreya M., Mumbai | Travel Blogger

★★★★☆

“I got ₹5,000 cashback in just 4 months. I shop often for home gadgets and clothing — the high monthly cap makes this card worth every rupee of the annual fee.”

– Aditya J., Chandigarh | Interior Designer

★★★★★

“Great for someone who doesn’t want to calculate points or redeem vouchers. It just works — I use it for Flipkart, MakeMyTrip, and Ajio. Cashback shows up clearly in my app.”

– Mansi K., Bhopal | Fashion Retailer

★★★★☆

“My wife and I use it as our primary card for household and travel spends. With no tracking or conversions, it’s our ‘fire-and-forget’ card. Fee got waived in year one.”

– Deepak R., Ahmedabad | Chartered Accountant

★★★★★

“I’ve used Axis ACE before, but SBI Cashback offers higher value on pure online shopping. The ₹5,000/month limit is enough for power users like me who shop in bulk.”

– Iqbal H., Kolkata | Online Reseller

★★★★★

💡 Insight: Users consistently praise this card for its effortless cashback model — no promo codes, no reward expiry, no tracking platforms.

If you shop online every week — groceries, gadgets, clothes, travel — this is one of the most straightforward ways to earn cashback in 2025. I personally save around ₹700/month without using any reward portal or coupon site.

📌 Disclaimer: Quotes are paraphrased from public reviews. Actual cashback may vary based on spend categories and SBI Card T&Cs. Visit the official SBI Cashback Card page for details.

The SBI Cashback Credit Card is perfect for high online spenders — but if your spending habits don’t align with how it rewards users, you might not extract its full value. Here’s when this card may not be the best fit:

📌 Mismatch Alert: If you’re looking for offline cashback, travel privileges, or UPI-centric rewards — the Flipkart Axis, Axis ACE, or IDFC Classic might align better with your needs.

💡 Tip: I found this card most rewarding when I shifted all my gadget, fashion, and grocery orders online. But in my first month, when I only paid rent and utilities — I earned zero cashback.

The SBI Cashback Credit Card is a no-nonsense, direct cashback card made for users who love online shopping. With 5% flat cashback on online purchases and 1% on all other spends, this card is ideal if you primarily shop via e-commerce platforms or food apps. Best of all — it’s completely free for moderate spenders thanks to a low annual fee that gets waived easily.

🏁 Final Verdict: If you’re a regular online shopper or someone who orders food, books cabs, or shops on Amazon/Flipkart — the SBI Cashback Credit Card gives unmatched flat-rate returns. I’ve saved over ₹900 last month just using it for Flipkart + Zomato orders — and didn’t need to track a single point. It’s efficient, easy, and highly recommended for digital-first spenders.

The SBI Cashback Credit Card is one of the strongest flat-rate cashback cards in India — especially for frequent online shoppers and app-based spenders. It offers simple, automatic cashback on almost all e-commerce transactions — with no reward tracking or redemption hassles.

Personally, I use this card for nearly every online purchase — from Flipkart deals to Swiggy orders — and I’ve earned close to ₹950 in cashback last month alone. The best part? It’s auto-credited to my card bill, so I don’t have to lift a finger.

If your monthly online spending crosses ₹15,000 — across food, fashion, or electronics — this card can easily give you ₹600–₹900 cashback without effort. I’ve linked it to my food delivery and e-commerce apps, and it’s become my go-to for quick savings on every transaction.

💸 Annual Fee: ₹999 (waived on ₹2L annual spend)

🛍️ Best For: People who shop online frequently and want flat cashback without tracking reward points

You earn 5% cashback on online transactions (Amazon, Flipkart, Swiggy, Uber, etc.) and 1% cashback on offline spends. Cashback is capped to a maximum of ₹5,000/month, and is automatically credited within 2 working days after your statement is generated.

Cashback is not applicable on fuel, wallet reloads, rent payments, insurance premiums, education fees, government payments, EMIs, and jewelry purchases. These are specifically listed under exclusions in SBI’s T&Cs.

While you won’t earn cashback on fuel spends, SBI offers a 1% fuel surcharge waiver for transactions between ₹500–₹3,000 (maximum waiver of ₹100 per billing cycle).

No, SBI does not provide per-transaction cashback details. However, the total monthly cashback is reflected in your statement summary. You can use apps or Excel trackers to monitor it manually.

Indian residents aged 18+ with a good credit score and a stable income (salary slip or ITR) can apply online. Self-employed users are also eligible subject to verification.

Yes, SBI offers free add-on cards for your spouse, parents, siblings, or children (18+). You can request this via net banking or by visiting your nearest branch.

Yes, like any credit card, closing it can affect your credit utilization ratio and the average age of your accounts. If it’s your oldest or only card, consider the impact before cancelling.

Cashback earned is displayed in your monthly statement and also visible on the SBI Card app. It usually appears under “Statement Credit” and reflects within 48 hours of statement generation.

After testing and writing this SBI Cashback Credit Card Review, I believe it’s a top pick in 2025 for anyone who shops online regularly and prefers straightforward rewards. The cashback is flat, automatic, and requires zero effort — no codes, no conversions, no gimmicks.

Personally, I’ve earned over ₹900 a month just using this card for Flipkart, Swiggy, and recharge apps. I didn’t have to activate any offers or visit reward portals — and the ₹999 fee was waived within 5 months.

✅ Bottom Line: If you want a reliable cashback card that gives real value for everyday online spending, this one delivers exactly what it promises — no confusion, no complications, just money back to your statement.

🧑💼 Reviewed by: Tausif Shaikh, Credit Card Expert | 📆 Updated: June 2025

Tausif Shaikh is the Founder of Updatepedia.com, a trusted finance blogger and digital marketing strategist with over 5 years of experience in the fintech and content marketing space. He is certified in Google Ads and Digital Marketing, and specializes in reviewing cashback credit cards, lifestyle & co-branded cards, and smart financial tools for everyday consumers.

Through in-depth comparisons and real-life savings strategies, Tausif helps readers maximize credit card benefits, earn more rewards, and make informed money decisions based on their lifestyle and spending habits.

Follow Tausif for practical financial insights, unbiased reviews, and money-saving tips that actually work.

Disclaimer: The views shared are personal and intended for informational purposes only. Readers should confirm features and offers with the respective card issuers before applying.

Your feedback helps others make better decisions and discover the best cards for their needs.

Write a Review ➜